[ad_1]

When Nvidia introduced eye-popping earnings on Wednesday with three-digit year-over-year progress, it was straightforward to get caught up within the pleasure. The corporate introduced in $13.5 billion for the quarter, up 101% over the prior 12 months, and effectively over its $11 billion steerage. That’s definitely one thing to get enthusiastic about.

Nvidia is benefiting from being an organization in the best place on the proper time, the place its GPU chips are in excessive demand to run massive language fashions and different AI-fueled workloads. That in flip is driving Nvidia’s astonishing progress this quarter. (It’s price noting that the corporate set the groundwork for its present success a while in the past.)

“Information middle compute income practically tripled 12 months on 12 months, pushed primarily by accelerating demand for cloud from cloud service suppliers and enormous client web corporations for our HGX platform, the engine of generative and enormous language fashions,” Colette Kress, Nvidia’s government vp and chief monetary officer, mentioned within the post-earnings report name with analysts.

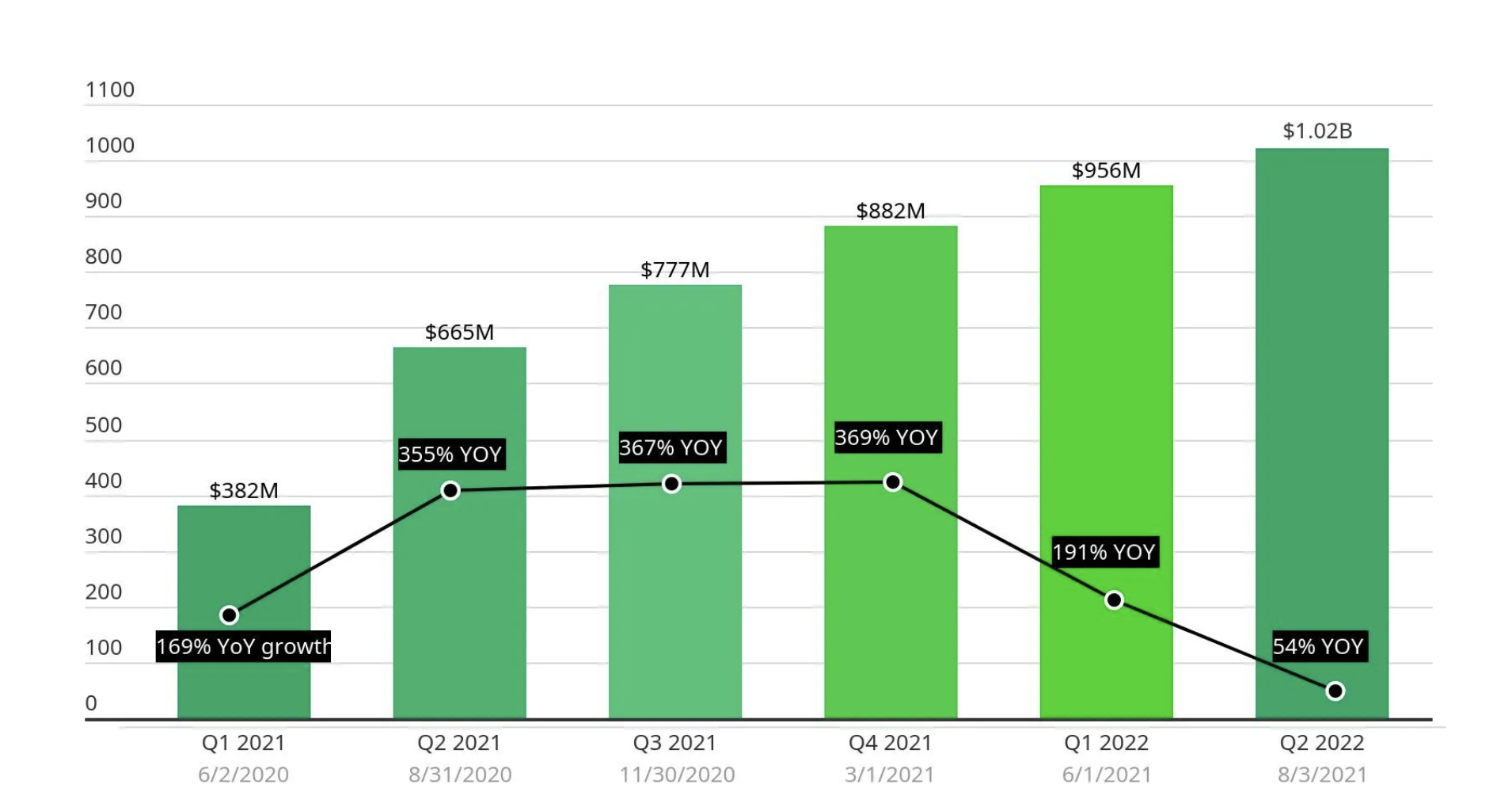

This sort of progress brings to thoughts the heady days of cloud shares, a few of which soared through the pandemic lockdown as corporations accelerated their utilization of SaaS to maintain their staff linked. Zoom, specifically, took off with 5 quarters of completely astonishing progress throughout that point.

Zoom’s pandemic fueled progress. Picture Credit: TechCrunch

At present, even double-digit progress is lengthy gone. For its most up-to-date report earlier this month, Zoom reported income of $1.138 billion, up 3.6% over the prior 12 months. That follows 5 straight quarters of single-digit progress, the final three within the low single digits.

Might Zoom probably be a cautionary story for a corporation like Nvidia driving the generative AI wave? And maybe extra importantly, will this drive unreasonable investor expectations about future efficiency because it did with Zoom?

Information middle demand isn’t going anyplace

It’s attention-grabbing to notice that Nvidia’s largest progress space is within the knowledge middle and that internet scalers are nonetheless constructing at a speedy tempo with plans so as to add over 300 new knowledge facilities within the coming years, per a Synergy Analysis report from March 2022.

“The long run seems to be shiny for hyperscale operators, with double-digit annual progress in complete revenues supported largely by cloud revenues that might be rising within the 20–30% per 12 months vary. This in flip will drive robust progress in capex typically and in knowledge middle spending particularly,” mentioned John Dinsdale, a chief analyst at Synergy Analysis Group, in a press release in regards to the report.

At the very least some share of this spending will certainly be dedicated to sources for operating AI workloads, and Nvidia ought to profit from that, CEO Jensen Huang instructed analysts on Wednesday. In actual fact, he believes that his firm’s expansive progress is far more than a flash within the pan.

“There’s about $1 trillion price of information facilities, name it, 1 / 4 of a trillion {dollars} of capital spend every year. You’re seeing that knowledge facilities around the globe are taking that capital spend and focusing it on the 2 most essential traits of computing at this time: accelerated computing and generative AI,” Huang mentioned. “And so I believe this isn’t a near-term factor. This can be a long-term business transition, and we’re seeing these two platform shifts taking place on the identical time.”

If he’s proper, maybe the corporate can maintain this degree of progress, however historical past means that what goes up should ultimately come down.

Enterprise gravity

If Zoom is any indication, some companies that see speedy progress for one motive or one other can maintain on to that income sooner or later. Whereas it’s definitely much less thrilling for buyers that Zoom’s progress fee has sharply moderated in latest quarters, it’s additionally true that Zoom has continued to develop. Which means it has retained all its prior scale after which some.

[ad_2]