[ad_1]

A reader asks:

My job is to run a concentrated 20 firm portfolio (all listed firms, purchase and maintain, long run horizon and so forth.). I get a base wage and a bonus for efficiency. So a very good quantity of my annual earnings are tied to the efficiency of the businesses I decide.

I even have a small private funding account. My query is round how I ought to take into consideration investing this – ought to I exploit the truth that I spend all of my time researching firms, and put money into these firms for myself, or ought to I keep away from the focus threat and simply go for a passive technique?

I really like questions like this since you might make a compelling argument both means.

On the one hand, it might make sense so that you can observe what you preach, have some pores and skin within the recreation, eat your individual cooking, and so forth. Why ought to your purchasers think about your technique if you happen to don’t have your individual cash invested proper alongside them?

However, if in case you have your entire cash on this technique you’re doubling down on focus threat. Not solely is your profession and incomes potential tied up in your organization, however the technique itself is concentrated within the variety of names you personal.

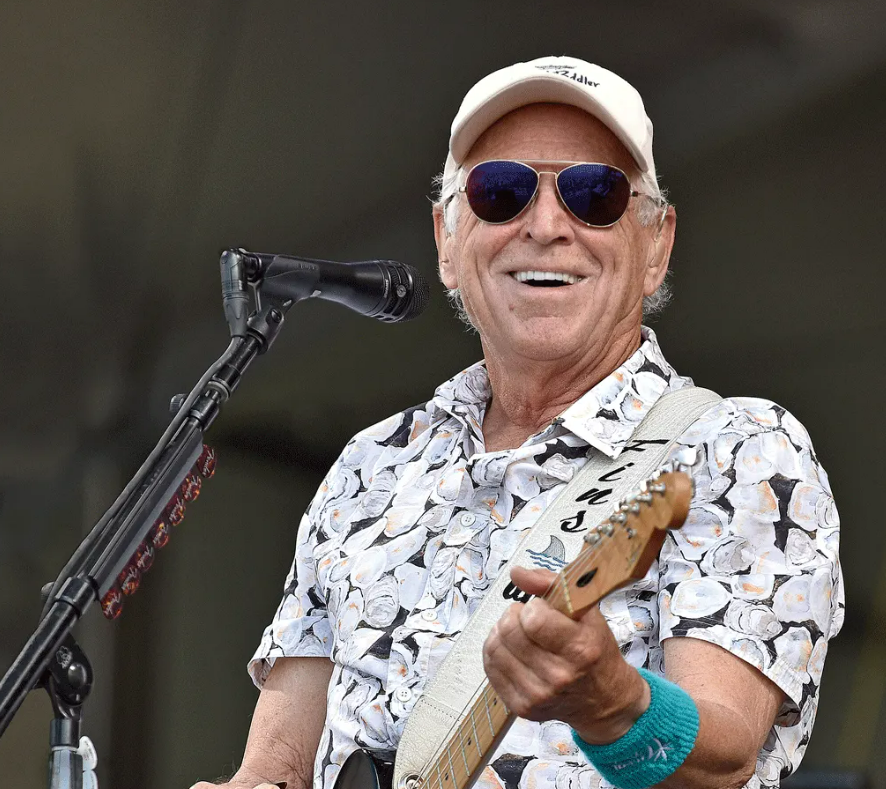

I used to be desirous about the thought of practising what you preach once I heard Jimmy Buffett handed away final weekend. I’ve been a Buffett fan for a very long time. I wore the Margaritaville t-shirts beginning in highschool. I went to certainly one of his concert events proper after faculty.1 His music remains to be on my audio system each summer time.

I even learn his biography. The man was an amazing storyteller with some superb tales. He actually did dwell it up when he was youthful. Consuming till the solar got here up. Island hopping. Sleeping on the seashore. Crusing. Visiting unique places.

Studying by way of the entire tributes, I used to be reminded of a New York Occasions profile from a number of years in the past referred to as Jimmy Buffett Does Not Dwell the Jimmy Buffett Way of life:

Jimmy Buffett will not be actually Jimmy Buffett anymore. He hasn’t been for some time. Jimmy Buffett — the nibbling on sponge cake, watching the solar bake, getting drunk and screwing, it’s 5 o’clock someplace Jimmy Buffett — has been changed with a well-preserved businessman who’s leveraging the Jimmy Buffett of yore in an effort to preserve the Jimmy Buffett of now within the method to which the previous Jimmy Buffett by no means dreamed he might develop into accustomed.

He solely often drinks margaritas as of late. “I don’t do sugar anymore,” he mentioned. “No sugar and no carbs. Besides on Sunday.” He doesn’t smoke pot anymore, both. Now he vapes oils, solely typically after work.

I had sophisticated emotions studying about Buffett’s transformation from seashore bum to businessman.

At first blush, it felt like false promoting. However then you definitely notice folks’s values and tasks change over time. The particular person you had been in your 20s will not be the particular person you’ll develop into in your 50s, 60s and past.

You may change and evolve as an investor over time as properly however I do assume there’s something to be mentioned for consuming your individual cheeseburgers in paradise.

Morninstar’s Jeff Ptak ran the numbers for me to see what number of portfolio managers put money into their very own funds.

Out of the practically 10,300 mutual funds and ETFs in america, there are greater than 5,900 the place the listed portfolio managers personal no shares within the fund they handle. The opposite 4,300 and alter have at the least one portfolio supervisor who owns shares of their very own fund.

This implies near 60% of funds and ETFs have portfolio managers who don’t personal any shares of the funds they’re operating. That sounds lower than very best.

I’m not saying that you must have your complete web value invested in your individual technique however it might be good if extra of those funding managers had at the least some pores and skin within the recreation.

I heard a narrative as soon as a couple of well-known quant hedge fund supervisor who retains his complete private portfolio in index funds. The reason was his complete livelihood is tied up within the quantitative funds he runs for the funding agency he’s part-owner of, so he was diversifying.

That is sensible from a profession threat perspective however I feel it’s hypocritical if you happen to anticipate purchasers to put money into methods you wouldn’t personally put money into.

Do I feel it is best to have your entire cash invested in a concentrated portfolio of shares that additionally pays your wage and bonus? No.

Do I feel it is best to make investments a few of your cash in your technique? Sure.

For those who’re recommending purchasers put all of their cash into the technique, you higher have some huge cash invested in it too.

However if you happen to’re recommending it makes a pleasant addition to a diversified portfolio then it might make sense you may have an identical funding stance.

Clearly, everybody has a distinct threat profile and time horizon however I like the thought of practising what you preach in relation to funding recommendation.

I make investments nearly all of my liquid web value in the identical funds and methods we use for consumer portfolios. I do have another investments for diversification functions however the bulk of my cash is invested similar to our purchasers.

We’ve an even bigger concentrate on monetary planning and asset allocation than a concentrated stock-picking technique. However I wouldn’t need to give recommendation to purchasers I wouldn’t observe myself if I had been of their sneakers.

We spoke about this query on the newest version of Ask the Compound:

Barry Ritholtz joined me once more this week to debate questions on when to promote a bond fund, when to promote particular person shares with large good points, the state of the U.S. financial system and what to put money into past your 401k.

Additional Studying:

My Evolution on Asset Allocation

1Such a enjoyable live performance. It was primarily an enormous get together.

[ad_2]