[ad_1]

U.S. householders’ insurance coverage is in place to enhance in 2024, in accordance Fitch Rankings.

The ranking company mentioned premium income progress, tied to current substantial worth will increase and extra diligent underwriting to handle danger concentrations and aggregations, factors to enchancment in 2024 underlying phase outcomes.

“Nevertheless, carriers could proceed to wrestle to generate underwriting beneficial properties relying on disaster loss expertise, and outcomes will fluctuate significantly,” added Fitch.

Fitch reported that business written premium progress is anticipated to exceed 12% in 2024 as carriers proceed to take substantial pricing and underwriting actions to return to price adequacy and enhance efficiency. In fourth-quarter earnings disclosures, Vacationers Corp. reported a renewal premium change of 21% in householders, whereas Hartford Monetary reported a renewal written worth improve of 15%.

“Financial inflation has moderated, however insurers proceed to face loss value uncertainty from value volatility and lack of availability of key constructing supplies and parts and expert labor, in addition to increased reinsurance prices,” the Fitch article mentioned. “Amid potential for extra frequent giant convective storm occasions, underwriters are extra diligently managing danger concentrations and aggregations throughout all geographic areas.”

Revisiting 2023

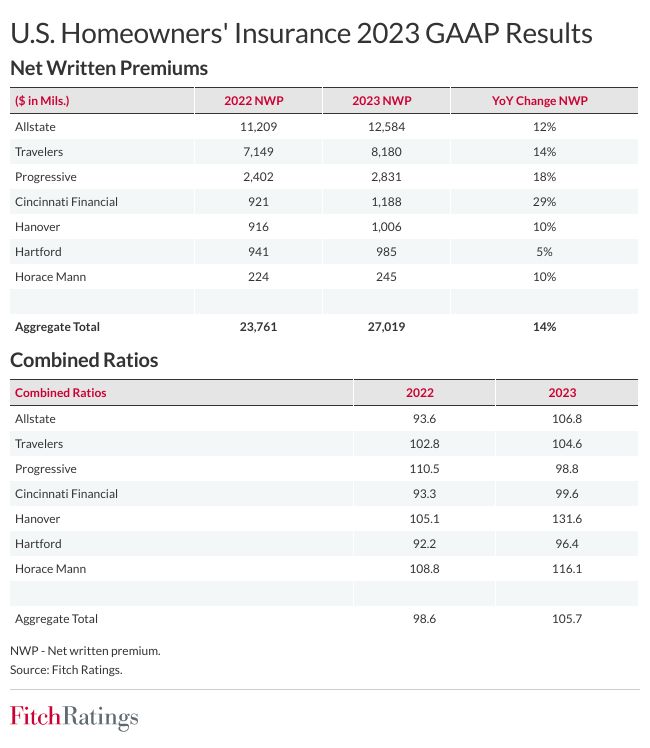

These predictions come after an evaluation seven publicly held householders insurers revealed 14% progress in web written premiums in combination and a seven-point mixed ratio improve to 105.7.

The Allstate Company, the second-largest U.S. householders author, reported a mixed ratio of 106.8 in 2023. Allstate’s mixed ratio was listed at 93.6 in 2022.

Fitch additionally highlighted variability in outcomes because of variations in catastrophe-related incurred losses. The Hanover Insurance coverage Group reported a 131.6 householders 2023 mixed ratio, whereas the Progressive Company dropped under 100 mixed ratio in 2023, due, partially, to fewer Florida insured losses.

The property and casualty insurance coverage business is anticipated to submit deterioration in householders’ statutory underwriting efficiency for the 12 months, with a phase mixed ratio projected at 109 in 2023 versus 104.4 in 2022, Fitch mentioned.

Full-year 2023 statutory householders mixed ratios will not be but out there, however important will increase in direct loss ratios for the primary 9 months of the 12 months point out “important deterioration in householders outcomes for the most important mutual insurers within the phase, together with State Farm, USAA, Liberty Mutual and American Household,” Fitch reported. The business direct loss ratio rose by 5 factors year-over-year to 82 on the finish of September 2023.

Inquisitive about Carriers?

Get computerized alerts for this subject.

[ad_2]