[ad_1]

Perfios, an Indian fintech that gives real-time credit score underwriting options to banks and non-banking monetary establishments, has raised $229 million in a brand new funding spherical because it seems to be deepen its enlargement in North America and Europe.

The 15-year-old startup’s Sequence D funding was led by Indian non-public fairness agency Kedaara Capital. The brand new funding included some secondary gross sales, however the startup didn’t specify the quantity. The Bengaluru-headquartered agency, which additionally counts Warburg Pincus and Bessemer Enterprise Companions amongst its backers, has raised $384 million in main and secondary transactions to this point, in line with Tracxn.

The additional participation from non-public fairness companies means that Perfios, which operates in 18 geographies, is not less than starting to organize for its preliminary public providing. (PEs are inclined to get entangled with startups, not less than these within the Asia area, two to a few years earlier than their IPO.) Replace: Perfios stated it’s focusing on to go public in 18 to 24 months.

Perfios operates various providers that permit companies to automate mortgage selections, supply insights right into a buyer’s monetary worthiness, and combination knowledge for APIs. It provides each mannequin and mortgage insights, makes use of AI and ML strategies, and is tailor-made for numerous monetary merchandise.

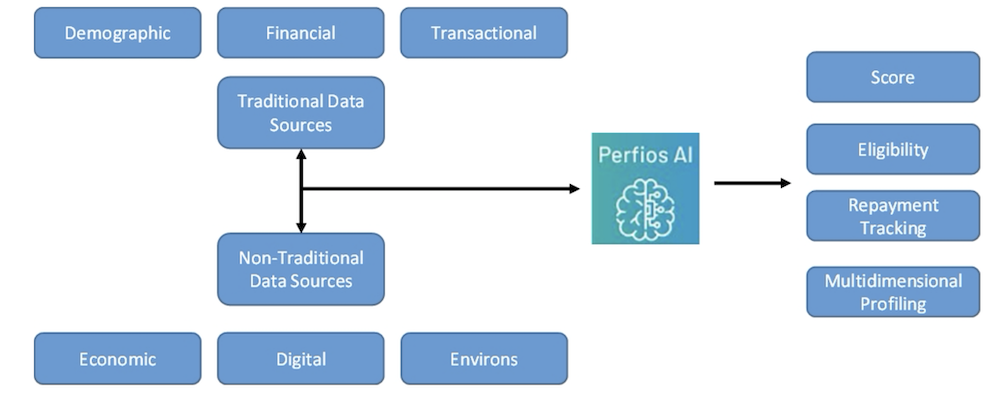

The platform adapts and learns by itself, and might forecast traits in new markets or areas. With its digital scoring, Perfios AI provides general scores, detailed breakdowns, and options to judge credit score danger effectively, Bernstein analysts stated in a current report.

Perfios’ credit score decisioning instruments (Picture: AllianceBernstein)

“Since our inception in 2008, Perfios has constantly led the way in which as a category-creating chief within the SaaS area. I’m full of immense gratitude and pleasure to have led this journey with our 1000+ trusted companions,” stated Sabyasachi Goswami, chief government of Perfios, in a press release.

“This funding will assist us in strengthening the digital transformation journey of our companions, thereby powering monetary inclusion and offering entry to monetary providers to billions throughout the globe.”

Perfios claimed that it’s the market chief in India and has a powerful footprint within the Center East and Southeast Asia. “Perfios has created actually the best-in-class fintech SaaS enterprise that performs on the robust secular development and rising digitization ranges within the monetary providers sector in India and globally,” stated Nishant Sharma, founder and managing accomplice a Kedaara Capital, in a press release.

Perfios’ massive funding comes at a time when most startups globally are struggling to boost new capital as traders develop into cautious of the general public markets situation.

[ad_2]