[ad_1]

This publish takes up from two earlier posts (half 1; half 2), asking simply what will we (we economists) actually learn about how rates of interest have an effect on inflation. At the moment, what does up to date financial idea say?

As chances are you’ll recall, the usual story says that the Fed raises rates of interest; inflation (and anticipated inflation) do not instantly bounce up, so actual rates of interest rise; with some lag, greater actual rates of interest push down employment and output (IS); with some extra lag, the softer financial system results in decrease costs and wages (Phillips curve). So greater rates of interest decrease future inflation, albeit with “lengthy and variable lags.”

Greater rates of interest -> (lag) decrease output, employment -> (lag) decrease inflation.

Partly 1, we noticed that it is not straightforward to see that story within the information. Partly 2, we noticed that half a century of formal empirical work additionally leaves that conclusion on very shaky floor.

As they are saying on the College of Chicago, “Properly, a lot for the actual world, how does it work in idea?” That is a crucial query. We by no means actually imagine issues we do not have a idea for, and for good motive. So, at present, let’s take a look at what fashionable idea has to say about this query. And they aren’t unrelated questions. Principle has been attempting to duplicate this story for many years.

The reply: Trendy (something publish 1972) idea actually doesn’t assist this concept. The usual new-Keynesian mannequin doesn’t produce something like the usual story. Fashions that modify that easy mannequin to attain one thing like results of the usual story accomplish that with an extended checklist of advanced elements. The brand new elements aren’t simply adequate, they’re (apparently) essential to provide the specified dynamic sample. Even these fashions don’t implement the verbal logic above. If the sample that prime rates of interest decrease inflation over a couple of years is true, it’s by a very totally different mechanism than the story tells.

I conclude that we do not have a easy financial mannequin that produces the usual perception. (“Easy” and “financial” are necessary qualifiers.)

The straightforward new-Keynesian mannequin

The central downside comes from the Phillips curve. The fashionable Phillips curve asserts that price-setters are forward-looking. In the event that they know inflation might be excessive subsequent 12 months, they increase costs now. So

Inflation at present = anticipated inflation subsequent 12 months + (coefficient) x output hole.

[pi_t = E_tpi_{t+1} + kappa x_t](If you realize sufficient to complain about (betaapprox0.99) in entrance of (E_tpi_{t+1}) you realize sufficient that it does not matter for the problems right here.)

Now, if the Fed raises rates of interest, and if (if) that lowers output or raises unemployment, inflation at present goes down.

The difficulty is, that is not what we’re in search of. Inflation goes down at present, ((pi_t))relative to anticipated inflation subsequent 12 months ((E_tpi_{t+1})). So the next rate of interest and decrease output correlate with inflation that’s rising over time.

Here’s a concrete instance:

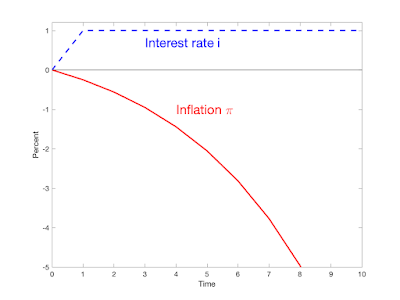

The plot is the response of the usual three equation new-Keynesian mannequin to an (varepsilon_1) shock at time 1:[begin{align} x_t &= E_t x_{t+1} – sigma(i_t – E_tpi_{t+1}) pi_t & = beta E_t pi_{t+1} + kappa x_t i_t &= phi pi_t + u_t u_t &= eta u_{t-1} + varepsilon_t. end{align}] Right here (x) is output, (i) is the rate of interest, (pi) is inflation, (eta=0.6), (sigma=1), (kappa=0.25), (beta=0.95), (phi=1.2).

On this plot, greater rates of interest are stated to decrease inflation. However they decrease inflation instantly, on the day of the rate of interest shock. Then, as defined above, inflation rises over time.

In the usual view, and the empirical estimates from the final publish, the next rate of interest has no instant impact, after which future inflation is decrease. See plots within the final publish, or this one from Romer and Romer’s 2023 abstract:

Inflation leaping down after which rising sooner or later is sort of totally different from inflation that does nothing instantly, would possibly even rise for a couple of months, after which begins gently happening.

You would possibly even surprise in regards to the downward bounce in inflation. The Phillips curve makes it clear why present inflation is decrease than anticipated future inflation, however why does not present inflation keep the identical, and even rise, and anticipated future inflation rise extra? That is the “equilibrium choice” concern. All these paths are potential, and also you want additional guidelines to select a selected one. Fiscal idea factors out that the downward bounce wants a fiscal tightening, so represents a joint monetary-fiscal coverage. However we do not argue about that at present. Take the usual new Keynesian mannequin precisely as is, with passive fiscal coverage and commonplace equilibrium choice guidelines. It predicts that inflation jumps down instantly after which rises over time. It doesn’t predict that inflation slowly declines over time.

This isn’t a brand new concern. Larry Ball (1994) first identified that the usual new Keynesian Phillips curve says that inflation is excessive when inflation is excessive relative to anticipated future inflation, that’s when inflation is declining. Commonplace beliefs go the opposite means: output is excessive when inflation is rising.

The IS curve is a key a part of the general prediction, and output faces the same downside. I simply assumed above that output falls when rates of interest rise. Within the mannequin it does; output follows a path with the identical form as inflation in my little plot. Output additionally jumps down after which rises over time. Right here too, the (a lot stronger) empirical proof says that an rate of interest rise doesn’t change output instantly, and output then falls quite than rises over time. The instinct has even clearer economics behind it: Greater actual rates of interest induce folks to eat much less at present and extra tomorrow. Greater actual rates of interest ought to go together with greater, not decrease, future consumption progress. Once more, the mannequin solely apparently reverses the signal by having output bounce down earlier than rising.

Key points

How can we be right here, 40 years later, and the benchmark textbook mannequin so completely doesn’t replicate commonplace beliefs about financial coverage?

One reply, I imagine, is complicated adjustment to equilibrium with equilibrium dynamics. The mannequin generates inflation decrease than yesterday (time 0 to time 1) and decrease than it in any other case can be (time 1 with out shock vs time 1 with shock). Now, all financial fashions are a bit stylized. It is simple to say that after we add varied frictions, “decrease than yesterday” or “decrease than it could have been” is an effective parable for “goes down over time.” If in a easy provide and demand graph we are saying that a rise in demand raises costs immediately, we naturally perceive that as a parable for a drawn out interval of worth will increase as soon as we add acceptable frictions.

However dynamic macroeconomics does not work that means. We have now already added what was speculated to be the central friction, sticky costs. Dynamic economics is meant to explain the time-path of variables already, with no additional parables. If adjustment to equilibrium takes time, then mannequin that.

The IS and Phillips curve are ahead trying, like inventory costs. It might make little sense to say “information comes out that the corporate won’t ever earn a living, so the inventory worth ought to decline step by step over a couple of years.” It ought to bounce down now. Inflation and output behave that means in the usual mannequin.

A second confusion, I believe, is between sticky costs and sticky inflation. The brand new-Keynesian mannequin posits, and an enormous empirical literature examines, sticky costs. However that isn’t the identical factor as sticky inflation. Costs will be arbitrarily sticky and inflation, the primary spinoff of costs, can nonetheless bounce. Within the Calvo mannequin, think about that solely a tiny fraction of corporations can change costs at every immediate. However once they do, they are going to change costs lots, and the general worth degree will begin rising instantly. Within the continuous-time model of the mannequin, costs are steady (sticky), however inflation jumps in the mean time of the shock.

The usual story needs sticky inflation. Many authors clarify the new-Keynesian mannequin with sentences like “the Fed raises rates of interest. Costs are sticky, so inflation cannot go up instantly and actual rates of interest are greater.” That is improper. Inflation can rise instantly. In the usual new-Keynesian mannequin it does so with (eta=1), for any quantity of worth stickiness. Inflation rises instantly with a persistent financial coverage shock.

Simply get it out of your heads. The usual mannequin doesn’t produce the usual story.

The plain response is, let’s add elements to the usual mannequin and see if we are able to modify the response operate to look one thing just like the widespread beliefs and VAR estimates. Let’s go.

Adaptive expectations

We are able to reproduce commonplace beliefs about financial coverage with totally adaptive expectations, within the Nineteen Seventies ISLM kind. I believe it is a massive a part of what most coverage makers and commenters keep in mind.

Modify the above mannequin to go away out the dynamic a part of the intertemporal substitution equation, to simply say in quite advert hoc means that greater actual rates of interest decrease output, and specify that the anticipated inflation that drives the actual charge and that drives pricing choices is mechanically equal to earlier inflation, (E_t pi_{t+1} = pi_{t-1}). We get [ begin{align} x_t &= -sigma (i_t – pi_{t-1}) pi_t & = pi_{t-1} + kappa x_t .end{align}] We are able to remedy this sytsem analytically to [pi_t = (1+sigmakappa)pi_{t-1} + sigmakappa i_t.]

Here is what occurs if the Fed completely raises the rate of interest. Greater rates of interest ship future inflation down. ((kappa=0.25, sigma=1.)) Inflation ultimately spirals away, however central banks do not go away rates of interest alone eternally. If we add a Taylor rule response (i_t = phi pi_t + u_t), so the central financial institution reacts to the rising spiral, we get this response to a everlasting financial coverage disturbance (u_t):

The upper rate of interest units off a deflation spiral. However the Fed rapidly follows inflation right down to stabilize the state of affairs. That is, I believe, the standard story of the Nineteen Eighties.

By way of elements, an apparently minor change of index from (E_t pi_{t+1}) to (pi_{t-1}) is in truth an enormous change. It means immediately that greater output comes with rising inflation, not reducing inflation, fixing Ball’s puzzle. The change mainly adjustments the signal of output within the Phillips curve.

Once more, it is probably not all within the Phillips curve. This mannequin with rational expectations within the IS equation and adaptive within the Phillips curve produces junk. To get the consequence you want adaptive expectations in all places.

The adaptive expectations mannequin will get the specified consequence by altering the fundamental signal and stability properties of the mannequin. Beneath rational expectations the mannequin is secure; inflation goes away all by itself beneath an rate of interest peg. With adaptive expectations, the mannequin is unstable. Inflation or deflation spiral away beneath an rate of interest peg or on the zero sure. The Fed’s job is like balancing a brush the other way up. In the event you transfer the underside (rates of interest) a method, the broom zooms off the opposite means. With rational expectations, the mannequin is secure, like a pendulum. This isn’t a small wrinkle designed to switch dynamics. That is main surgical procedure. Additionally it is a sturdy property: small adjustments in parameters don’t change the dominant eigenvalue of a mannequin from over one to lower than one.

A extra refined method to seize how Fed officers and pundits suppose and discuss is perhaps referred to as “briefly mounted expectations.” Coverage folks do discuss in regards to the fashionable Phillips curve; they are saying inflation is determined by inflation expectations and employment. Expectations aren’t mechanically adaptive. Expectations are a 3rd drive, generally “anchored,” and amenable to manipulation by speeches and dot plots. Crucially, on this evaluation, anticipated inflation doesn’t transfer when the Fed adjustments rates of interest. Expectations are then very slowly adaptive, if inflation is persistent, or if there’s a extra common lack of religion in “anchoring.” Within the above new-Keynesian mannequin graph, on the minute the Fed raises the rate of interest, anticipated inflation jumps as much as observe the graph’s plot of the mannequin’s forecast of inflation.

As a easy method to seize these beliefs, suppose expectations are mounted or “anchored” at (pi^e). Then my easy mannequin is [begin{align}x_t & = -sigma(i_t – pi^e) pi_t & = pi^e + kappa x_tend{align}]so [pi_t = pi^e – sigma kappa (i_t – pi^e).] Inflation is predicted inflation, and lowered by greater rates of interest (final – signal). However these charges want solely be greater than the mounted expectations; they don’t have to be greater than previous charges as they do within the adaptive expectations mannequin. That is why the Fed thinks 3% rates of interest with 5% inflation remains to be “contractionary”–expected inflation stays at 2%, not the 5% of current adaptive expertise. Additionally by fixing expectations, I take away the instability of the adaptive expectations mannequin… as long as these expectations keep anchored. The Fed acknowledges that ultimately greater inflation strikes the expectations, and with a perception that’s adaptive, they worry that an inflation spiral can nonetheless get away.

Even this view doesn’t give us any lags, nevertheless. The Fed and commenters clearly imagine that greater actual rates of interest at present decrease output subsequent 12 months, not instantly; they usually imagine that decrease output and employment at present drive inflation down sooner or later, not instantly. They imagine one thing like [begin{align}x_{t+1} &= – sigma(i_t – pi^e) pi_{t+1} &= pi^e + kappa x_t.end{align}]

However now we’re on the type of non-economic ad-hockery that the entire Nineteen Seventies revolution deserted. And for a motive: Advert hoc fashions are unstable, regimes are at all times altering. Furthermore, let me remind you of our quest: Is there a easy financial mannequin of financial coverage that generates one thing like the usual view? At this degree of ad-hockery you would possibly as nicely simply write down the coefficients of Romer and Romer’s response operate and name that the mannequin of how rates of interest have an effect on inflation.

Tutorial economics gave up on mechanical expectations and ad-hoc fashions within the Nineteen Seventies. You’ll be able to’t publish a paper with this kind of mannequin. So after I imply a “fashionable” mannequin, I imply rational expectations, or not less than the consistency situation that the expectations in the mannequin aren’t basically totally different from forecasts of the mannequin. (Fashions with specific studying or different expectation-formation frictions depend too.)

It is simple to puff about folks aren’t rational, and looking the window plenty of folks do dumb issues. But when we take that view, then the entire mission of financial coverage on the proposition that persons are basically unable to be taught patterns within the financial system, {that a} benevolent Federal Reserve can trick the poor little souls into a greater final result. And in some way the Fed is the lone super-rational actor who can keep away from all these pesky behavioral biases.

We’re in search of the minimal essential elements to explain the fundamental indicators and performance of financial coverage. A little bit of irrational or advanced expectation formation as icing on the cake, a potential adequate ingredient to provide quantitatively real looking dynamics, is not terrible. However it could be unhappy if irrational expectations or different conduct is a essential ingredient to get probably the most primary signal and story of financial coverage proper. If persistent irrationality is a central essential ingredient for the fundamental signal and operation of financial coverage — if greater rates of interest will increase inflation the minute folks smarten up; if there is no such thing as a easy provide and demand, MV=PY wise economics underlying the fundamental operation of financial coverage; if it is all a conjuring trick — that ought to actually weaken our religion in the entire financial coverage mission.

Info assist, and we do not have to get non secular about it. Through the lengthy zero sure, the identical commentators and central bankers stored warning a couple of deflation spiral, clearly predicted by this mannequin. It by no means occurred. Rates of interest beneath inflation from 2021 to 2023 ought to have led to an upward inflation spiral. It by no means occurred — inflation eased all by itself with rates of interest beneath inflation.Getting the specified response to rates of interest by making the mannequin unstable is not tenable whether or not or not you just like the ingredient. Inflation additionally surged within the Nineteen Seventies quicker than adaptive expectations got here near predicting, and fell quicker within the Nineteen Eighties. The ends of many inflations include credible adjustments in regime.

There may be quite a lot of work now desperately attempting to repair new-Keynesian fashions by making them extra old-Keynesian, placing lagged inflation within the Phillips curve, present earnings within the IS equation, and so forth. Advanced studying and expectation formation tales substitute the simplistic adaptive expectations right here. So far as I can inform, to the extent they work they largely accomplish that in the identical means, by reversing the fundamental stability of the mannequin.

Modifying the new-Keynesian mannequin

The choice is so as to add elements to the fundamental new-Keynesian mannequin, sustaining its insistence on actual “micro-founded” economics and forward-looking conduct, and describing specific dynamics because the evolution of equilibrium portions.

The strong line is the VAR level estimate and grey shading is the 95% confidence band. The strong blue line is the primary mannequin. The dashed line is the mannequin with solely worth stickiness, to emphasise the significance of wage stickiness. The shock occurs at time 0. Discover the funds charge line that jumps down at that date. That the opposite traces don’t transfer at time 0 is a consequence. I graphed the response to a time 1 shock above.

That is the reply, now what is the query? What elements did they add above the textbook mannequin to reverse the fundamental signal and bounce downside and to provide these fairly footage? Here’s a partial checklist:

- Behavior formation. The utility operate is (log(c_t – bc_{t-1})).

- A capital inventory with adjustment prices in funding. Adjustment prices are proportional to funding progress, ([1-S(i_t/i_{t-1})]i_t), quite than the standard formulation wherein adjustment prices are proportional to the funding to capital ratio (S(i_t/k_t)i_t).

- Variable capital utilization. Capital providers (k_t) are associated to the capital inventory (bar{ok}t) by (k_t = u_t bar{ok}_t). The utilization charge (u_t) is about by households dealing with an upward sloping value (a(u_t)bar{ok}_t).

- Calvo pricing with indexation: Companies randomly get to reset costs, however corporations that are not allowed to reset costs do robotically increase costs on the charge of inflation.

- Costs are additionally mounted for 1 / 4. Technically, corporations should publish costs earlier than they see the interval’s shocks.

- Sticky wages, additionally with indexation. Households are monopoly suppliers of labor, and set wages Calvo-style like corporations. (Later papers put all households right into a union which does the wage setting.) Wages are additionally listed; Households that do not get to reoptimize their wage nonetheless increase wages following inflation.

- Companies should borrow working capital to finance their wage invoice 1 / 4 prematurely, and thus pay a curiosity on the wage invoice.

- Cash within the utility operate, and cash provide management. Financial coverage is a change within the cash progress charge, not a pure rate of interest goal.

Whew! However which of those elements are essential, and that are simply adequate? Realizing the authors, I strongly suspect that they’re all essential to get the suite of outcomes. They do not add elements for present. However they need to match all the impulse response capabilities, not simply the inflation response. Maybe an easier set of elements might generate the inflation response whereas lacking a number of the others.

Let’s perceive what every of those elements is doing, which can assist us to see (if) they’re essential and important to getting the specified consequence.

I see a standard theme in behavior formation, adjustment prices that scale by funding progress, and indexation. These elements every add a spinoff; they take a regular relationship between ranges of financial variables and alter it to at least one in progress charges. Every of consumption, funding, and inflation is a “bounce variable” in commonplace economics, like inventory costs. Consumption (roughly) jumps to the current worth of future earnings. The extent of funding is proportional to the inventory worth in the usual q idea, and jumps when there may be new data. Iterating ahead the new-Keynesian Phillips curve (pi_t = beta E_t pi_{t+1} + kappa x_t), inflation jumps to the discounted sum of future output gaps, (pi_t = E_t sum_{j=0}^infty beta^jx_{t+j}.)

To provide responses wherein output, consumption and funding in addition to inflation rise slowly after a shock, we do not need ranges of consumption, funding, and inflation to leap this fashion. As a substitute we would like progress charges to take action. With commonplace utility, the patron’s linearized first order situation equates anticipated consumption progress to the rate of interest, ( E_t (c_{t+1}/c_t) = delta + r_t ) Behavior, with (b=1) offers ( E_t [(c_{t+1}-c_t)/(c_t-c_{t-1})] = delta + r_t ). (I not noted the strategic phrases.) Mixing logs and ranges a bit, you possibly can see we put a progress charge rather than a degree. (The paper has (b=0.65) .) An funding adjustment value operate with (S(i_t/i_{t-1})) quite than the usual (S(i_t/k_t)) places a spinoff rather than a degree. Usually we inform a narrative that in order for you a home painted, doubling the variety of painters does not get the job completed twice as quick as a result of they get in one another’s means. However you possibly can double the variety of painters in a single day if you wish to accomplish that. Right here the fee is on the enhance in variety of painters every day. Indexation leads to a Phillips curve with a lagged inflation time period, and that provides “sticky inflation.” The Phillips curve of the mannequin (32) and (33) is [pi_t = frac{1}{1+beta}pi_{t-1} + frac{beta}{1+beta}E_{t-1}pi_{t+1} + (text{constants}) E_{t-1}s_t]the place (s_t) are marginal prices (extra later). The (E_{t-1}) come from the belief that costs cannot react to time (t) data. Iterate that ahead to (33)[pi_t – pi_{t-1} = (text{constants}) E_{t-1}sum_{j=0}^infty beta^j s_{t+j}.] We have now efficiently put the change in inflation rather than the extent of inflation.

The Phillips curve is anchored by actual marginal prices, and they aren’t proportional to output on this mannequin as they’re within the textbook mannequin above. That is necessary too. As a substitute,[s_t = (text{constants}) (r^k_t)^alpha left(frac{W_t}{P_t}R_tright)^{1-alpha}] the place (r^ok) is the return to capital (W/P) is the actual wage and (R) is the nominal rate of interest. The latter time period crops up from the belief that corporations should borrow the wage invoice one interval prematurely.

That is an attention-grabbing ingredient. There may be quite a lot of discuss that greater rates of interest increase prices for corporations, and they’re decreasing output consequently. Which may get us round a number of the IS curve issues. However that is not the way it works right here.

Here is how I believe it really works. Greater rates of interest increase marginal prices, and thus push up present inflation relative to anticipated future inflation. The equilibrium-selection guidelines and the rule towards immediate worth adjustments (arising subsequent) tie down present inflation, so the upper rates of interest must push down anticipated future inflation.

CEE disagree (p. 28). Writing of an rate of interest decline, so all of the indicators are reverse of my tales,

… the rate of interest seems in corporations’ marginal value. Because the rate of interest drops after an expansionary financial coverage shock, the mannequin embeds a drive that pushes marginal prices down for a time frame. Certainly, within the estimated benchmark mannequin the impact is robust sufficient to induce a transient fall in inflation.

However pushing marginal prices down lowers present inflation relative to future inflation — they’re trying on the identical Phillips curve simply above. It seems to be to me like they’re complicated present with anticipated future inflation. Instinct is tough. There are many Fisherian forces on this mannequin that need decrease rates of interest to decrease inflation.

This shift additionally factors to the central conundrum of the Phillips curve. Right here it describes the adjustment of costs to wages or “prices” extra typically. It basically describes a relative worth, not a worth degree. OK, however the phenomenon we need to clarify is the widespread element, how all costs and wage tie collectively or equivalently the decline within the worth of the forex, stripped of relative worth actions. The central puzzle of macroeconomics is why the widespread element, an increase or fall of all costs and wages collectively, has something to do with output, and for us how it’s managed by the Fed.

Christiano Eichenbaum and Evans write (p.3) that “it’s essential to permit for variable capital utilization.” I will strive clarify why in my very own phrases. With out capital adjustment prices, any change in the actual return results in an enormous funding bounce. (r=f'(ok)) should bounce and that takes quite a lot of additional (ok). We add adjustment prices to tamp down the funding response. However now when there may be any shock, capital cannot modify sufficient and there’s a large charge of return response. So we’d like one thing that acts like an enormous bounce within the capital inventory to tamp down (r=f'(ok)) variability, however not an enormous funding bounce. Variable capital utilization acts like the large funding bounce with out us seeing an enormous funding bounce. And all that is going to be necessary for inflation too. Keep in mind the Phillips curve; if output jumps then inflation jumps too.

Sticky wages are essential, and certainly CEE report that they will dispense with sticky costs. One motive is that in any other case income are countercyclical. In a increase, costs go up quicker than wages so income go up. With sticky costs and versatile wages you get the other signal. It is attention-grabbing that the “textbook” mannequin has not moved this fashion. Once more, we do not usually sufficient write textbooks.

Fixing costs and wages through the interval of the shock by assuming worth setters cannot see the shock for 1 / 4 has a direct impact: It stops any worth or wage jumps through the quarter of the shock, as in my first graph. That is nearly dishonest. Observe the VAR additionally has completely zero instantaneous inflation response. This too is by assumption. They “orthogonalize” the variables so that every one the contemporaneous correlation between financial coverage shocks and inflation or output is taken into account a part of the Fed’s “rule” and none of it displays within-quarter response of costs or portions to the Fed’s actions.

Step again and admire. Given the mission “discover embellishments of the usual new-Keynesian mannequin to match VAR impulse response capabilities” might you could have give you any of this?

However again to our job. That is quite a lot of apparently essential elements. And studying right here or CEE’s verbal instinct, the logic of this mannequin is nothing like the usual easy instinct, which incorporates not one of the essential elements. Do we actually want all of this to provide the fundamental sample of financial coverage? So far as we all know, we do.

And therefore, that sample will not be as sturdy because it appears. For all of those elements are fairly, … imaginative. Actually, we’re a good distance from the Lucas/Prescott imaginative and prescient that macroeconomic fashions must be primarily based on nicely tried and measured microeconomic elements which might be believably invariant to adjustments within the coverage regime.

That is about the place we’re. Regardless of the beautiful response capabilities, I nonetheless rating that we do not have a dependable, easy, financial mannequin that produces the usual view of financial coverage.

Mankiw and Reis, sticky expectations

Mankiw and Reis (2002) expressed the problem clearly over 20 years in the past. In reference to the “commonplace” New-Keynesian Phillips curve (pi_t = beta E_t pi_{t+1} + kappa x_t) they write a good looking and succinct paragraph:

Ball [1994a] reveals that the mannequin yields the shocking consequence that introduced, credible disinflations trigger booms quite than recessions. Fuhrer and Moore [1995] argue that it can’t clarify why inflation is so persistent. Mankiw [2001] notes that it has hassle explaining why shocks to financial coverage have a delayed and gradual impact on inflation. These issues seem to come up from the identical supply: though the worth degree is sticky on this mannequin, the inflation charge can change rapidly. Against this, empirical analyses of the inflation course of (e.g., Gordon [1997]) usually give a big position to “inflation inertia.”

At the price of repetition, I emphasize the final sentence as a result of it’s so neglected. Sticky costs aren’t sticky inflation. Ball already stated this in 1994:

Taylor (1979, 198) and Blanchard (1983, 1986) present that staggering produces inertia within the worth degree: costs simply slowly to a fall in th cash provide. …Disinflation, nevertheless, is a change within the progress charge of cash not a one-time shock to the extent. In casual discussions, analysts usually assume that the inertia consequence carries over from ranges to progress charges — that inflation adjusts slowly to a fall in cash progress.

As I see it, Mankiw and Reis generalize the Lucas (1972) Phillips curve. For Lucas, roughly, output is expounded to sudden inflation[pi_t = E_{t-1}pi_t + kappa x_t.] Companies do not see everybody else’s costs within the interval. Thus, when a agency sees an sudden rise in costs, it does not know if it’s a greater relative worth or the next common worth degree; the agency expands output primarily based on how a lot it thinks the occasion is perhaps a relative worth enhance. I like this mannequin for a lot of causes, however one, which appears to have fallen by the wayside, is that it explicitly founds the Phillips curve in corporations’ confusion about relative costs vs. the worth degree, and thus faces as much as the issue why ought to an increase within the worth degree have any actual results.

Mankiw and Reis mainly suppose that corporations discover out the overall worth degree with lags, so output is determined by inflation relative to a distributed lag of its expectations. It is clearest for the worth degree (p. 1300)[p_t = lambdasum_{j=0}^infty (1-lambda)^j E_{t-j}(p_t + alpha x_t).] The inflation expression is [pi_t = frac{alpha lambda}{1-lambda}x_t + lambda sum_{j=0}^infty (1-lambda)^j E_{t-1-j}(pi_t + alpha Delta x_t).](Among the complication is that you really want it to be (pi_t = sum_{j=0}^infty E_{t-1-j}pi_t + kappa x_t), however output does not enter that means.)

This appears completely pure and wise to me. What’s a “interval” anyway? It is sensible that corporations be taught heterogeneously whether or not a worth enhance is relative or worth degree. And it clearly solves the central persistence downside with the Lucas (1972) mannequin, that it solely produces a one-period output motion. Properly, what’s a interval anyway? (Mankiw and Reis do not promote it this fashion, and really do not cite Lucas in any respect. Curious.)

It isn’t instantly apparent that this curve solves the Ball puzzle and the declining inflation puzzle, and certainly one should put it in a full mannequin to take action. Mankiw and Reis (2002) combine it with (m_t + v = p_t + x_t) and make some stylized evaluation, however do not present the right way to put the thought in fashions equivalent to I began with or make a plot.

Their much less well-known observe on paper Sticky Info in Basic Equilibrium (2007) is significantly better for this function as a result of they do present you the right way to put the thought in an specific new-Keynesian mannequin, just like the one I began with. Additionally they add a Taylor rule, and an rate of interest quite than cash provide instrument, together with wage stickiness and some different elements,. They present the right way to remedy the mannequin overcoming the issue that there are various lagged expectations as state variables. However right here is the response to the financial coverage shock:

|

| Response to a Financial Coverage Shock, Mankiw and Reis (2007). |

Sadly they do not report how rates of interest reply to the shock. I presume rates of interest went down briefly.

Look: the inflation and output hole plots are about the identical. Aside from the slight delay going up, these are precisely the responses of the usual NK mannequin. When output is excessive, inflation is excessive and declining. The entire level was to provide a mannequin wherein excessive output degree would correspond to rising inflation. Relative to the primary graph, the primary enchancment is only a slight hump form in each inflation and output responses.

Describing the identical mannequin in “Pervasive Stickiness” (2006), Mankiw and Reis describe the desideratum nicely:

The Acceleration Phenomenon….inflation tends to rise when the financial system is booming and falls when financial exercise is depressed. That is the central perception of the empirical literature on the Phillips curve. One easy method to illustrate this truth is to correlate the change in inflation, (pi_{t+2}-pi_{t-2}) with [the level of] output, (y_t), detrended with the HP filter. In U.S. quarterly information from 1954-Q3 to 2005-Q3, the correlation is 0.47. That’s, the change in inflation is procyclical.

Now look once more on the graph. So far as I can see, it is not there. Is that this model of sticky inflation a bust, for this function?

I nonetheless suppose it is a neat thought price extra exploration. However I believed so 20 years in the past too. Mankiw and Reis have quite a lot of citations however no person adopted them. Why not? I think it is a part of a common sample that plenty of nice micro sticky worth papers aren’t used as a result of they do not produce a simple combination Phillips curve. If you’d like cites, ensure folks can plug it in to Dynare. Mankiw and Reis’ curve is fairly easy, however you continue to must hold all previous expectations round as a state variable. There could also be alternative routes of doing that with fashionable computational know-how, placing it in a Markov setting or slicing off the lags, everybody learns the worth degree after 5 years. Hank fashions have even larger state areas!

Some extra fashions

What about throughout the Fed? Chung, Kiley, and Laforte 2010, “Documentation of the Estimated, Dynamic, Optimization-based (EDO) Mannequin of the U.S. Financial system: 2010 Model” is one such mannequin. (Due to Ben Moll, in a lecture slide titled “Results of rate of interest hike in U.S. Fed’s personal New Keynesian mannequin”) They describe it as

This paper supplies documentation for a large-scale estimated DSGE mannequin of the U.S. financial system – the Federal Reserve Board’s Estimated, Dynamic, Optimization- primarily based (FRB/EDO) mannequin mission. The mannequin can be utilized to handle a variety of sensible coverage questions on a routine foundation.

Listed here are the central plots for our function: The response of rates of interest and inflation to a financial coverage shock.

No lengthy and variable lags right here. Simply as within the easy mannequin, inflation jumps down on the day of the shock after which reverts. As with Mankiw and Reis, there’s a tiny hump form, however that is it. That is nothing just like the Romer and Romer plot.

Right here is their central graph of the response to a financial coverage shock

Once more, there’s a little hump-shape, however the total image is rather like the one we began with. Inflation principally jumps down instantly after which recovers; the rate of interest shock results in future inflation that’s greater, not decrease than present inflation. There are not any lags from greater rates of interest to future inflation declines.

Closing ideas

I will reiterate the primary level. So far as I can inform, there is no such thing as a easy financial mannequin that produces the usual perception.

Now, possibly perception is correct and fashions simply must catch up. It’s attention-grabbing that there’s so little effort occurring to do that. As above, the huge outpouring of new-Keynesian modeling has been so as to add much more elements. Partly, once more, that is the pure pressures of journal publication. However I believe it is also an trustworthy feeling that after Christiano Eichenbaun and Evans, it is a solved downside and including different elements is all there may be to do.

So a part of the purpose of this publish (and “Expectations and the neutrality of rates of interest“) is to argue that that is not a solved downside, and that eradicating elements to seek out the only financial mannequin that may produce commonplace beliefs is a extremely necessary job. Then, does the mannequin incorporate something at all the commonplace instinct, or is it primarily based on some totally different mechanism al collectively? These are first order necessary and unresolved questions!

However for my lay readers, right here is so far as I do know the place we’re. In the event you, just like the Fed, maintain to plain beliefs that greater rates of interest decrease future output and inflation with lengthy and variable lags, know there is no such thing as a easy financial idea behind that perception, and positively the usual story is just not how financial fashions of the final 4 a long time work.

[ad_2]