[ad_1]

“Nowcasts” of GDP progress are designed to trace the economic system in actual time by incorporating info from an array of indicators as they’re launched. In April 2016, the New York Fed’s Analysis Group launched the New York Fed Employees Nowcast, a dynamic issue mannequin that generated estimates of present quarter GDP progress at a weekly frequency. The onset of the COVID-19 pandemic sparked widespread financial disruptions—and unprecedented fluctuations within the financial knowledge that movement into the Employees Nowcast. This posed important challenges to the mannequin, resulting in the suspension of publication in September 2021. Making the most of current developments in time-series econometrics, we’ve got since developed a extra sturdy model of the Employees Nowcast mannequin, one which higher handles knowledge volatility. On this publish, we talk about the mannequin’s new options, current estimates of present quarter GDP progress, and consider how the Employees Nowcast would have carried out through the pandemic interval. As we speak’s publish marks the resumption of normal New York Fed Employees Nowcast releases, to be printed every Friday.

What’s New within the Mannequin?

A dynamic issue mannequin postulates {that a} sure variety of noticed variables are pushed by a small variety of dynamic unobserved (latent) components, whereas options particular to every collection are captured by idiosyncratic errors. The mannequin processes incoming knowledge releases, recording as “information” any discrepancies between the enter collection and the mannequin’s prediction for that knowledge launch. This “information”, in flip, impacts the mannequin’s GDP progress estimate in line with the load that it attributes to the brand new info. Constructing on this primary construction, the brand new mannequin specification contains a number of options that higher allow it to deal with extremely unstable knowledge like these noticed through the pandemic. We sketch these options under (see this paper for a extra in depth dialogue).

First, we’ve got launched stochastic volatility and outlier adjustment to the latent variable dynamics. Moreover, relative to the legacy mannequin, we let the lags of 1 issue have an effect on the present worth of one other issue, which permits the mannequin to seize extra basic lead-lag relationships between variable subgroups. The nonlinear dynamics within the issue replace equations cut back the mannequin’s sensitivity to massive shocks, making certain that the mannequin can deal with smaller surprises as regular with out overreacting to the drastic deviations noticed through the COVID-19 pandemic. The addition of those richer dynamics within the latent variables improves the mannequin’s forecasting efficiency.

We additionally modified the specification of the loading construction. As within the legacy mannequin, each collection hundreds on a single “world” issue, whereas particular subgroups of collection load on extra components. Particularly, we embrace a “smooth” issue to seize native correlations in survey knowledge and a “labor” issue for collection pertaining to labor market variables, as within the legacy mannequin. For the brand new specification, we substitute the “actual” issue with a “nominal” issue, onto which load collection that measure value ranges or enter the mannequin in nominal phrases. Importantly, we embrace a fifth “COVID” issue, solely energetic from March to September of 2020, to seize correlated variation in a number of collection that have been affected by the pandemic. This latent issue construction permits the mannequin to higher deal with the varieties of maximum knowledge releases seen through the pandemic, a case examine mentioned on the finish of this publish.

Lastly, we use a Bayesian estimation strategy, which allows us to report chance intervals alongside every level estimate of actual GDP progress.

The right way to Learn the Mannequin’s Output

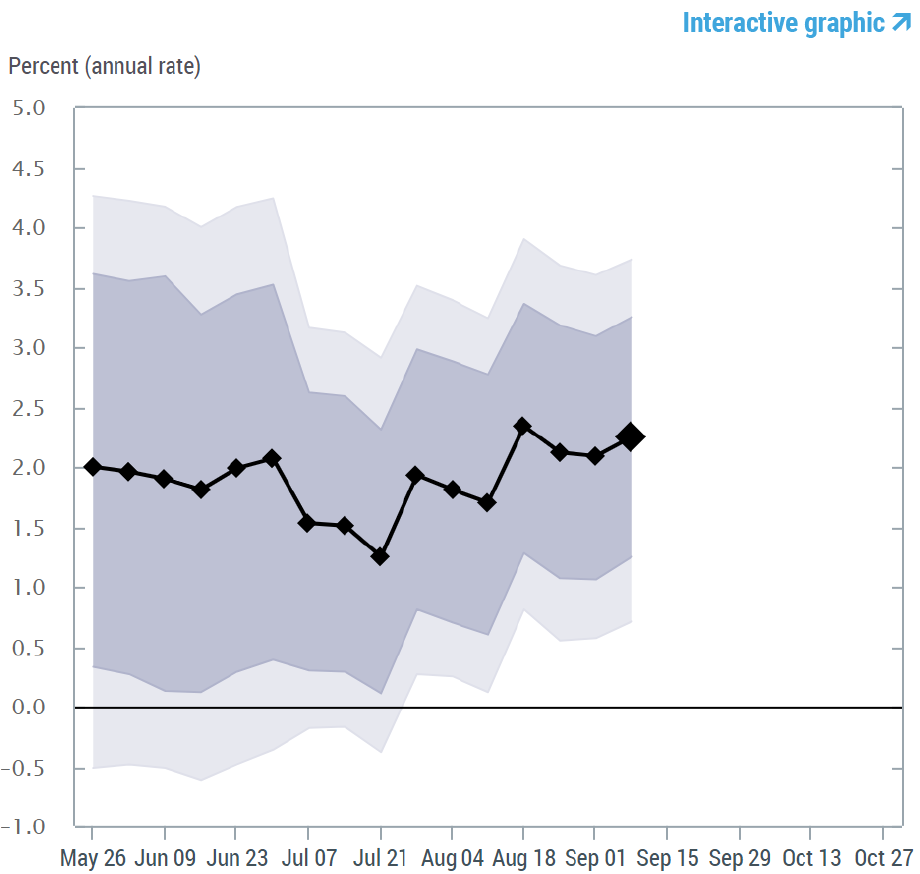

The visualization of the real-time evolution of our GDP progress estimate in a specific quarter is much like the one we had for the legacy mannequin, however is displayed in two charts, as offered under for 2023:Q3. The charts can be up to date weekly till the advance estimate of GDP for Q3 is launched on October 26, after which we’ll solely challenge up to date estimates for progress within the following quarter. Within the first chart, the black line represents the evolution of the Employees Nowcast, with the diamonds indicating the purpose estimate at every replace, primarily based on info accessible at the moment. This chart additionally contains chance bands that measure the uncertainty of the estimate and are designed to comprise the noticed worth for GDP progress with 50 p.c and 68 p.c chance.

New York Fed Employees Nowcast, September 8, 2023

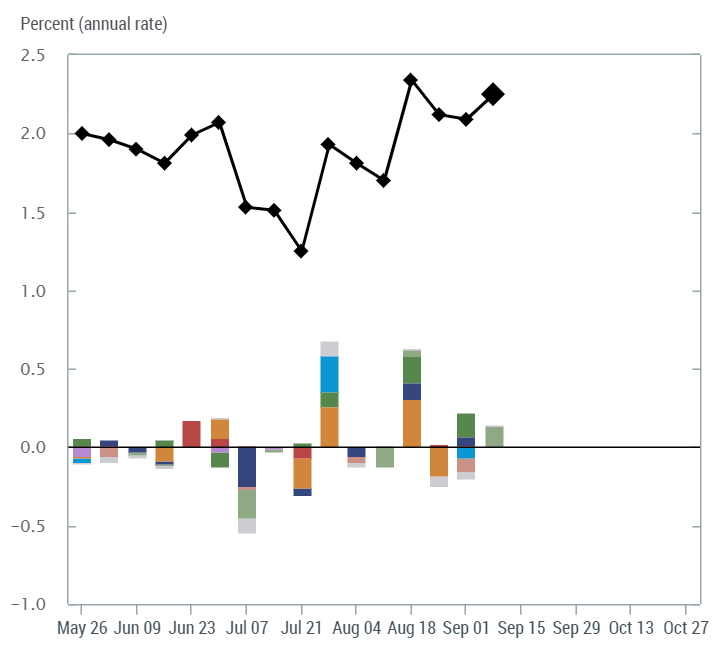

The second chart represents the contribution of every piece of “information” to the change within the Employees Nowcast for the week. Recall that “information” is the distinction between every knowledge launch all through the week and the mannequin prediction for that launch. This “information” is translated into an affect on the GDP progress estimate primarily based on a “weight” that represents the relevance of that variable for the GDP nowcast. We mixture information by color-coded classes, as displayed in the important thing. The sum of the impacts of the week’s information on the Employees Nowcast, represented by the coloured bars for every class, is the full change within the GDP progress estimate for that week. The accompanying desk supplies additional particulars. For instance, within the replace on Friday, July 7, 2023, the Employees Nowcast decreased by 0.6 proportion level relative to the earlier week attributable to adverse surprises in manufacturing survey knowledge and worldwide commerce knowledge.

New York Fed Employees Nowcast, September 8, 2023:

Influence of Knowledge Releases

The New York Fed Employees Nowcast over the Pandemic Interval

Have we constructed sufficient flexibility into the New York Fed Employees Nowcast mannequin to offer early indicators of financial contractions, even when these occur out of the blue? The COVID-19 recession was such an occasion: temporary, outlined by the NBER as lasting simply two months (with the height in February 2020 and the trough in April), but with a broad and deep affect on the economic system. Though on the onset of the pandemic we didn’t have the mannequin within the present kind, we’ve got reconstructed a weekly, real-time evolution of the New York Fed Employees Nowcast for 2020:Q2 and 202:Q3, by updating the estimates every week primarily based on the information accessible at the moment. This permits us to observe the mannequin efficiency over the sudden recession and restoration episodes.

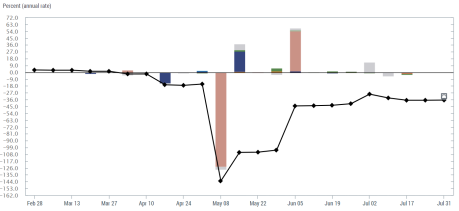

The chart under reveals the evolution of the Employees Nowcast for 2020:Q2. The primary indication of a recession occurred when the Employees Nowcast included the beginning-of-the-quarter parameter estimates on April 1. This estimation launched the COVID issue, which is simply energetic from March via September 2020. The primary important decline got here with massive adverse surprises in manufacturing survey knowledge in late April, adopted by a nosedive within the Employees Nowcast in early Could, when April labor market figures have been launched. The magnitude of the month-over-month drop in employment knowledge (payroll employment knowledge from BLS dropped by 20.2 million and unemployment jumped to 10.3 p.c) far exceed the mannequin’s forecasts, leading to a drop to -143.1 p.c. Some restoration within the Employees Nowcast occurred when the Empire State Manufacturing Survey got here out above expectations, and once more when the mannequin processed optimistic surprises within the Could labor market knowledge. The Employees Nowcast remained comparatively steady for the rest of the interval, reaching a remaining estimate of -36.6 p.c. For reference, the advance estimate of GDP progress for the second quarter, launched by the BEA on July 30, 2020, was -32.9, p.c, which was revised as much as -31.4 p.c within the third estimate, launched on September 30, 2020.

New York Fed Employees Nowcast for 2020:Q2

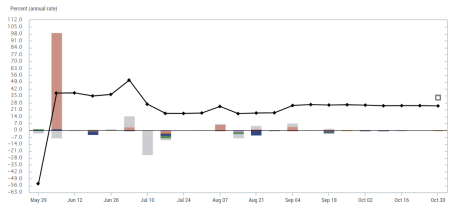

After the dramatic drop within the second quarter, GDP progress rebounded within the third quarter. The Employees Nowcast for 2020:Q3 tracks this rebound, recording an early leap from the preliminary estimate of -54.1 p.c to +38 p.c with the discharge of the Could labor market knowledge. The estimate reaches a excessive of +51.0 p.c on July 2 after a optimistic shock in non-public payroll employment, however that is tempered to +27.0 p.c after the July parameter re-estimation and downward revisions as adverse surprises from retail gross sales, manufacturing surveys, and industrial manufacturing are included. Fluctuations are small over the next weeks and the ultimate estimate is 24.9 p.c for the quarter. The advance estimate of GDP progress for Q3, launched on October 29, 2020, was +33.1 p.c, revised solely marginally (to +33.4 p.c) within the third estimate, launched on December 22, 2020.

New York Fed Employees Nowcast for 2020:Q3

General, the mannequin captures the dramatic, sudden drop in financial exercise in March-April 2020. The mannequin’s means to successfully course of massive knowledge surprises—each adverse and optimistic—over the pandemic interval showcases its flexibility. Regardless of massive swings within the Employees Nowcast level estimates throughout 2020 Q2, the chance intervals (not proven within the chart) stay comparatively tight. The 50 p.c and 68 p.c bands span 2.0 and a pair of.9 factors, respectively, at first of the quarter, with the interval rising to roughly 4.5 and 6.5 factors broad after the parameters are re-estimated in April. The chance intervals shrink to a width of two.0 and a pair of.8 factors by the top of the quarter. 2020 Q3 has wider confidence intervals over the interval in comparison with Q2, reflecting the interval’s even larger uncertainty. The 50 p.c and 68 p.c bands drop to a width of 1.8 and a pair of.7 factors by the top of the quarter.

Martín Almuzara is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Katie Baker is a former analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Hannah O’Keeffe is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Argia Sbordone is the top of Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

The right way to cite this publish:

Martin Almuzara, Katie Baker, Hannah O’Keeffe, and Argia Sbordone, “Reintroducing the New York Fed Employees Nowcast,” Federal Reserve Financial institution of New York Liberty Road Economics, September 8, 2023, https://libertystreeteconomics.newyorkfed.org/2023/09/reintroducing-the-new-york-fed-staff-nowcast/.

Disclaimer

The views expressed on this publish are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).

[ad_2]