[ad_1]

Mother and father, you possibly can even do that in your youngsters. Right here’s why I believe a Common Financial savings Plan (RSP) would be the top-of-the-line strikes you may make in your personal monetary future – whether or not by way of really beating inflation, cultivating optimistic monetary habits, automating your investments in order that it runs when you pursue your profession…and even as a instructing and legacy software whereas your youngsters are rising up.

After I first began investing in my early 20s, preliminary capital was an actual drawback.

Again in these days, the minimal lot dimension on SGX was 1,000 models. As an investor who needed to purchase simply 1 lot of DBS shares at ~$20 again then, I wanted to commit upfront a minimal of roughly $20,000 (1,000 x $20 = $20,000). I assumed that was a lot of cash for a brand new investor like me – for publicity into only one single inventory!

Fortunately, SGX diminished the minimal board dimension all the way down to 100 models in 2015, which then made particular person shares extra accessible for me. But when there may be one factor I want I had accomplished in a different way after I first began investing, it could have been to arrange a Common Financial savings Plan (RSP) proper from the beginning.

What I noticed was that many retail traders who began their investing journey in the course of the pandemic have been drawn by the attract of US shares and spurned the Singapore market. Many ended up shopping for hyped shares reminiscent of Tesla, Peloton or Palantir, inflicting their very own investing journey to be fraught with a lot volatility. The result at the moment? Many are sitting on losses now and never wanting to the touch – and even look – at their portfolio.

On my latest podcast interview with ex-GIC chief and former Presidential candidate Ng Kok Track, he identified that the US inventory market is now 70% of the worldwide market cap, but the American economic system is simply 20% of the worldwide economic system – a attainable signal that valuations are at inflated ranges, pushed up by know-how and AI shares in latest months.

When you requested me, I all the time really feel that it’s higher for brand new traders to begin with their house market to construct their circle of competence with a RSP first, reasonably than leap instantly into inventory selecting as an inexperienced beginner.

Not satisfied? Right here’s an instance again take a look at for instance.

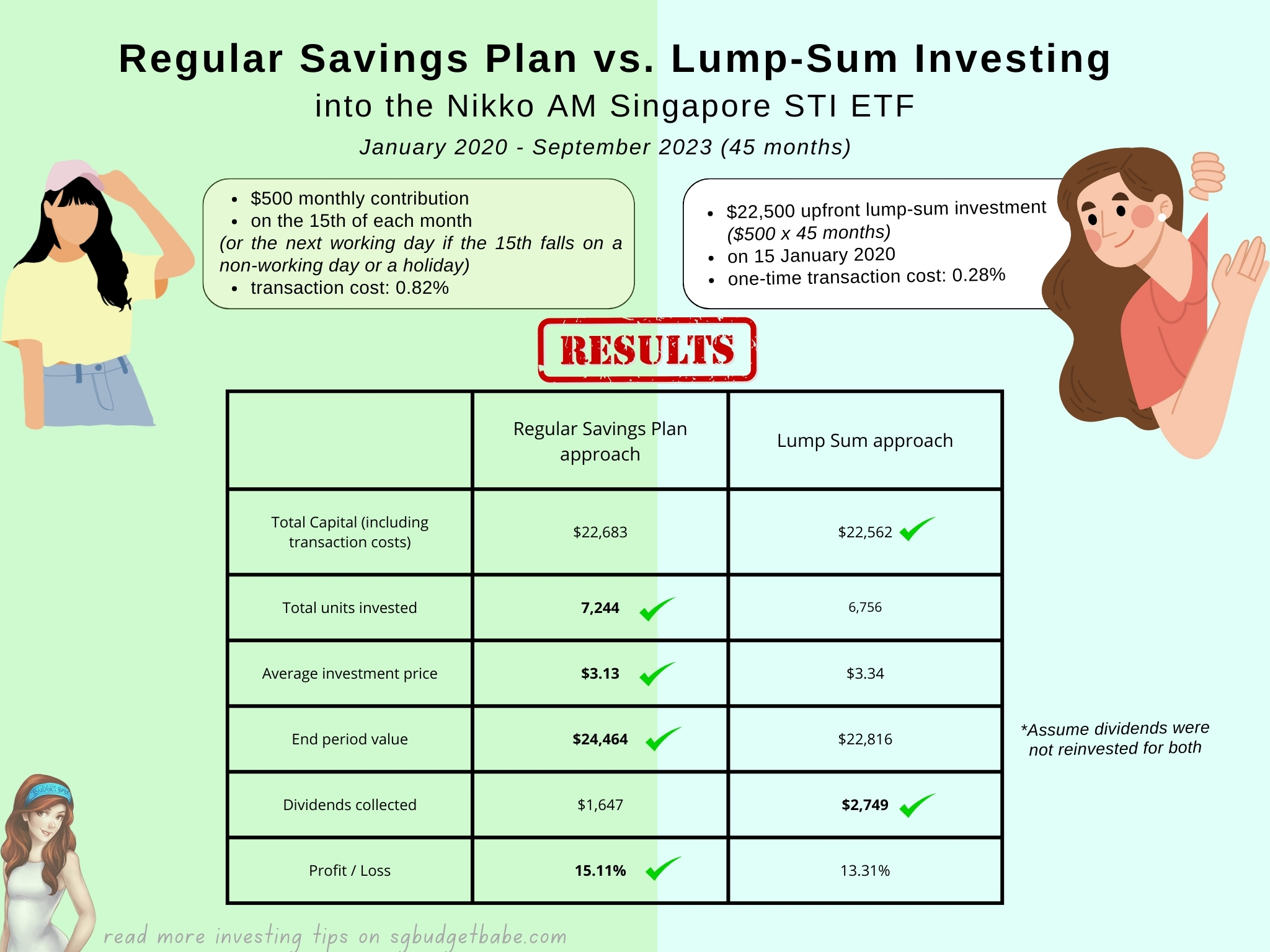

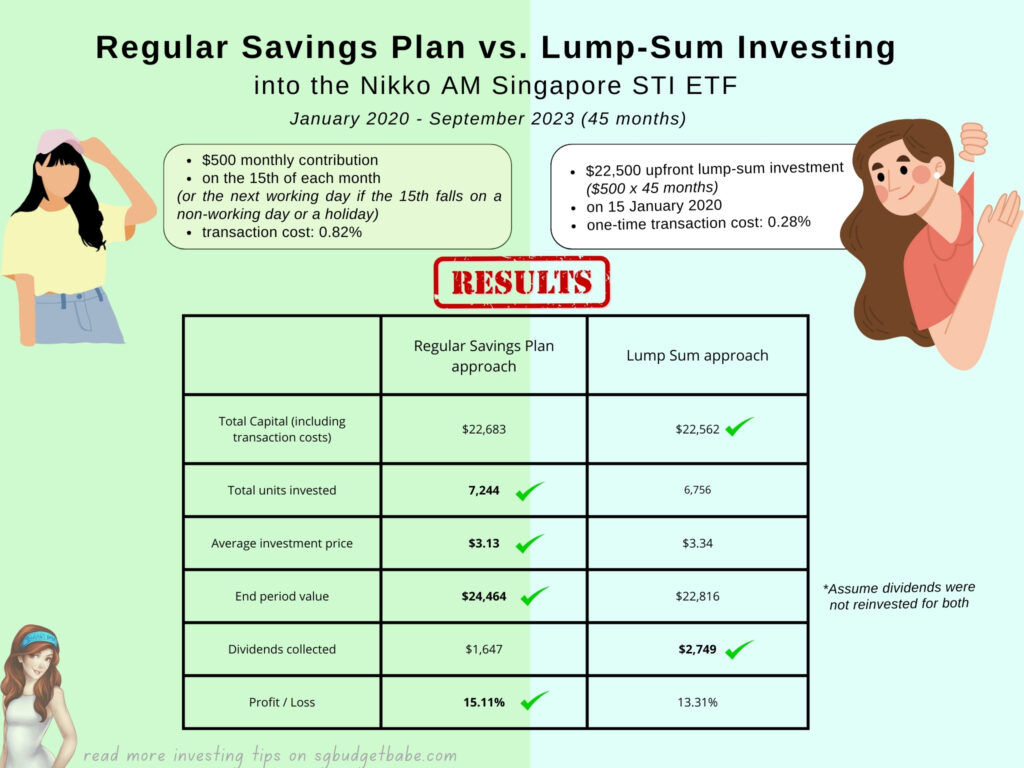

Let’s think about 2 traders, each of whom invested within the STI ETF in January 2020 and held their funding till now. One selected to do it through a RSP system of $500 a month, whereas the opposite had extra cash available and selected to take a position all the sum upfront ($500 x 45 months) in a single transfer:

For these 2 traders, we will see that the RSP method to investing throughout this era in query (January 2020 until now) yielded barely higher returns, and it didn’t require the investor to have a big preliminary funding quantity ($22,500) to deploy instantly on Day 1. As an alternative, the RSP investor was in a position to construct up her funding holdings slowly over time, and on this interval, ended up with much more models of the Nikko AM STI ETF than the lump-sum investor.

Now, this isn’t to say that commonly investing a set quantity (a.ok.a. Greenback Price Averaging, or DCA) will all the time outperform lump-sum investing, as completely different time intervals will yield completely different outcomes:

- In a rising market, lump sum will usually outperform DCA. The premise right here is that you’d have been lucky sufficient to time the market to have entered on the backside (or close to it) and also you had all the sum to deploy upfront at that cut-off date.

- In a U-shaped market, DCA usually outperforms lump sum investing.

- In a falling market, DCA usually outperforms lump sum investing.

Therefore, you possibly can see why DCA is such an ideal software for traders, because it distances you from the emotional curler coaster that comes with investing. It doesn’t require you to precisely time the market (one thing which even Warren Buffett has admitted he hasn’t the “faintest thought about”) and neither do you want to have your complete funding capital proper initially.

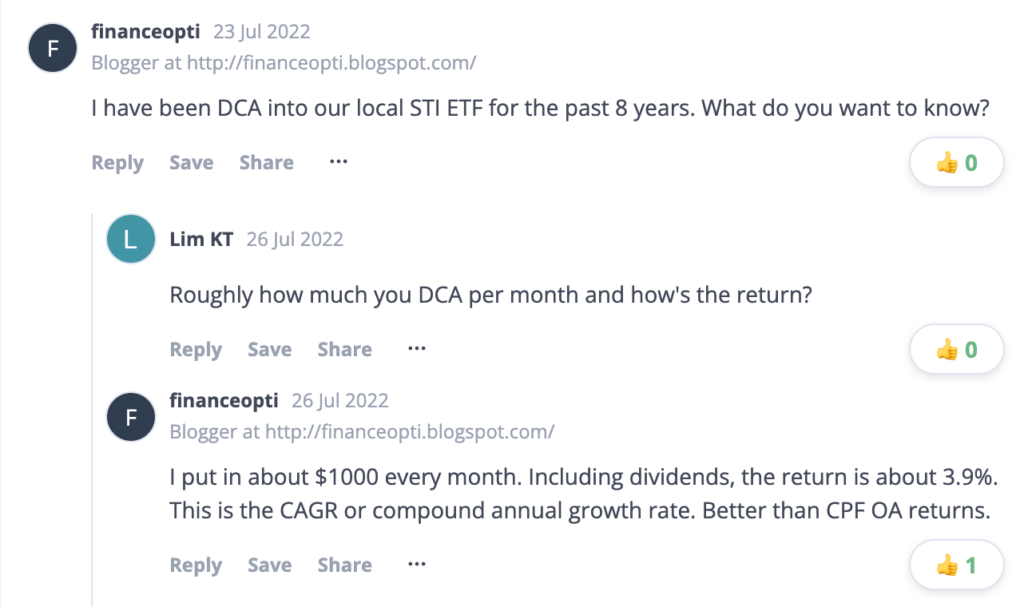

This isn’t simply all theoretical. Right here’s anecdotal proof I discovered which reveals there are actual individuals in Singapore who’ve been disciplined about this and seen optimistic returns utilizing the same method:

Within the bestselling ebook “Atomic Habits”, writer James Clear writes about tips on how to make good habits inevitable and dangerous habits inconceivable:

Make your dangerous habits harder by creating what psychologists name a dedication system i.e. a alternative you make within the current that controls your actions sooner or later. It’s a technique to lock in future behaviour, bind you to good habits, and prohibit you from dangerous ones.

The bottom line is to vary the duty such that it requires extra work to get out of the nice behavior than to get began on it. When the time involves act, the one technique to bail is to cancel the [commitment device], which requires extra effort and should value cash.

James Clear, from “Atomic Habits”

And when you requested me, establishing an RSP at the moment can probably be the top-of-the-line dedication gadgets you possibly can create in your monetary future. It would bind you to good habits (of disciplined investing) and prohibit you from dangerous ones (of trying to time the market, or ditching your investments during times of worry). So when the time involves act, the one technique to bail is to terminate your RSP, which requires you to take the hassle to do it however fortunately, is not going to value you cash as there are not any penalties or early termination charges not like an insurance coverage funding plan.

How do Common Financial savings Plans (RSPs) work?

For these of you who’re unfamiliar with RSPs, right here’s a fast crash course.

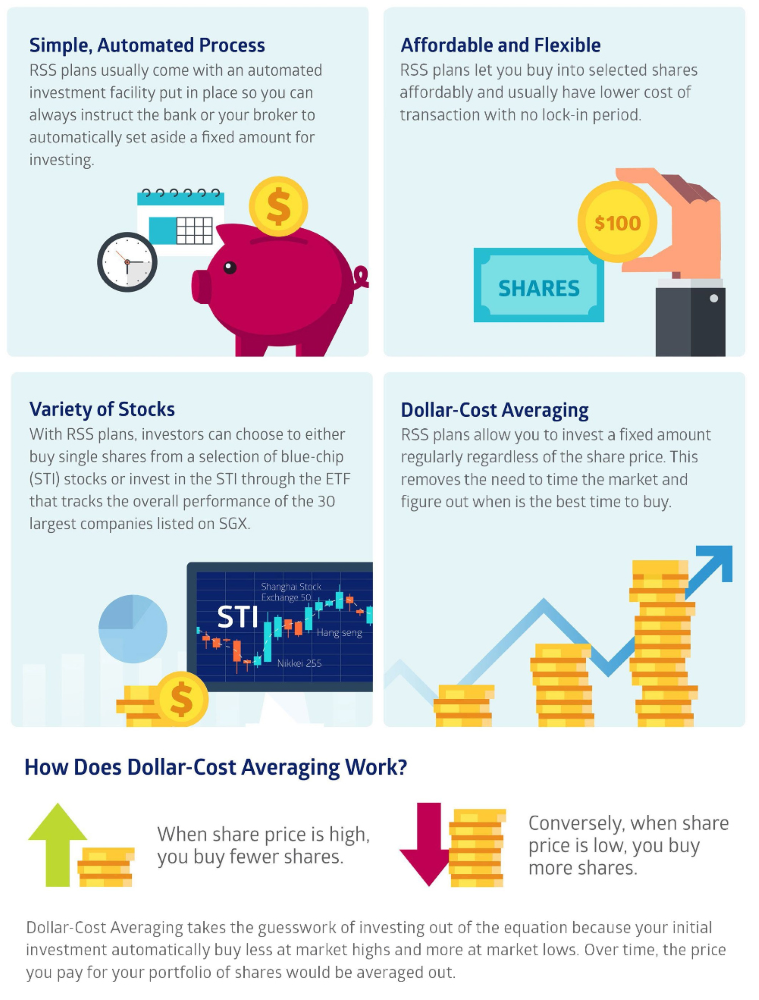

An RSP is solely a daily funding plan that helps you make investments a set sum of cash into shares, exchange-traded funds (ETFs) or unit trusts (UTs) on a periodic foundation each month. Whenever you arrange an RSP, you’ll be automating your investments to purchase extra shares when costs are low, and fewer shares when costs go up (see under chart from SGX Academy).

Most of us already do that naturally – top off on one thing when it’s low cost, and fewer when it’s costlier. The distinction is that an RSP mechanically does that for you, so that you don’t even have to carry a finger each month to attain that.

That is also referred to as Greenback Price Averaging (DCA), which is a straightforward however efficient technique to take a position, because it lets you keep away from timing the markets and keep invested over time to let your cash compound.

You’ll be able to arrange an RSP to greenback value common into your alternative of investments reminiscent of ETFs, unit trusts, particular person shares, and so forth. For many traders, as your investments add up over time, an RSP might be seen as one in every of your elementary constructing blocks in your funding portfolio, offering you with a stable capital base in direction of having a good nest-egg in your future.

Who’re RSPs appropriate for?

Given the relative hands-off nature of RSPs, they’re nice for the next teams:

- Individuals who do not need a big sum of cash (e.g. younger traders)

- Buyers who could not have adequate experience, time, means and assets to watch the market continually, and react accordingly.

- People who can’t be bothered to manually make investments every time and like to automate their investments, since RSPs run on auto-pilot after your preliminary arrange

- Mother and father who want to make investments for his or her youngsters with out an excessive amount of effort

As a father or mother myself, I discover RSPs an ideal software to make use of for youngsters when you’re hoping to lift them to turn into financially savvy, whereas leaving them a legacy portfolio for after they come of age, on the identical time. You’ll be able to learn my prior interview right here with a company high-flyer who makes use of this very same methodology for his children.

Organising your RSP on FSMOne

I’ve talked about how one can experience on Singapore’s financial development via numerous native ETFs supplied by NikkoAM a.ok.a. one of many extra respected ETF managers right here.

When you want to automate that, you possibly can take into account establishing a daily financial savings plan through FSMOne’s ETF RSP function.

Among the many native RSP suppliers, I like FSMOne essentially the most proper now as their prices are the bottom at simply 0.08% (min. S$1) per transaction (supply). No different brokerage comes shut, and the one cheaper manner can be to do it your self through a low-cost digital brokerage. In case you have numerous time, self-discipline and power however much less cash, then you possibly can determine for your self if the fee distinction is well worth the comfort of getting it automated for you.

P.S. Now you can get pleasure from 0% processing charges for RSPs on FSMOne from now till December 2023! As an investor, you can too choose your required frequency of how typically you want to purchase into the ETF each month, as much as a most of 4 instances monthly and with a minimal beginning quantity of simply S$50.

Message from Sponsor Make 2023 the yr you begin getting right into a behavior of investing commonly. As a bonus reward, you may even stroll away with some thrilling prizes reminiscent of a health watch (Apple Watch Sequence 9) or the most recent vacuum (Dyson V8 Slim Fluffy). From now till 22 October 2023, make investments a minimal of S$200 a month into any of the next Nikko Asset Administration ETFs through FSMOne’s ETF RSP function to be eligible for the fortunate draw: - Nikko AM Singapore STI ETF (G3B) - NikkoAM-ICBCSG China Bond ETF SGD (ZHS) - NikkoAM-StraitsTrading Asia ex Japan REIT ETF (CFA) - NikkoAM-StraitsTrading MSCI China Electrical Autos and Future Cellular ETF (EVS) - Nikko AM SGD Funding Grade Company Bond ETF (MBH) - Nikko AM ABF Singapore Bond Index Fund (A35) And when you’re a brand new FSMOne buyer opening your account for the primary time for this RSP promotion, you’ll additionally obtain $10 value of money credited to your FSMOne Money Account!

For the total particulars of the promotion, discover out extra right here!

Learn tips on how to arrange your ETF Common Financial savings Plan on FSMOne right here.

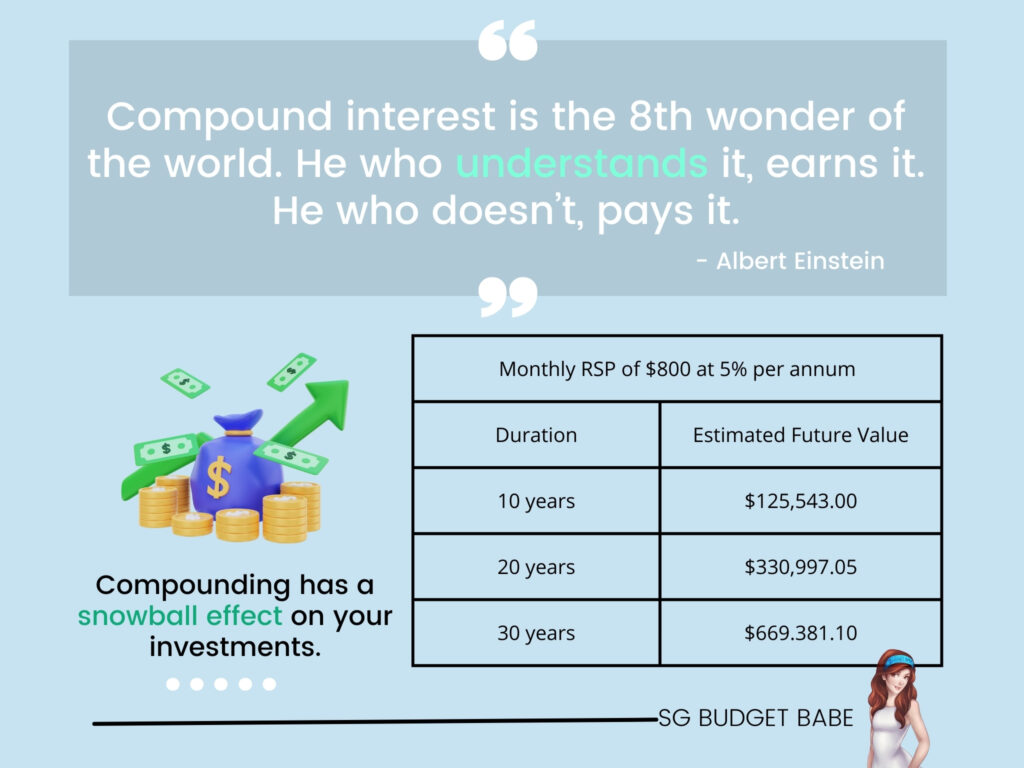

In the long term, the cumulative worth of your RSP investments will naturally develop, boosted by the facility of compounding. And the perfect half? You’d have been in a position to profit from essentially the most missed eighth marvel on this planet – compound curiosity (over time) – with out even doing something.

Disclaimer: Whether or not an RSP or lump-sum investing will work higher for you is a deeply private choice that you’ll have to make. There are not any ensures that both methodology will outperform the opposite because it is determined by many elements, a few of which have been highlighted. Investing includes a attainable lack of your capital and automating your investments via an RSP doesn’t defend you from this threat – nothing can. In case you are not a full-time investor who’s dedicated to monitoring the markets intently to behave on lump-sum investing every time the (time) alternative seems, then doing dollar-cost averaging via an RSP could also be an choice you need to take into account as an alternative.

Eager to be taught extra about the advantages of RSPs? Examine common investing on the Nikko AM web site right here.

TLDR Conclusion

As somebody who has been investing actively for over a decade, the largest mistake I see most individuals do at the moment isn’t establishing their elementary funding constructing blocks for his or her future.

If that’s you, and you’ve got been procrastinating on beginning your funding journey since you didn’t know tips on how to or are too overwhelmed to begin, then this text is for you.

When you ask me, I really feel you may make an actual distinction to your individual monetary future whenever you arrange a Common Financial savings Plan as a dedication system.

With the convenience of use, low minimal sums (from as little as $50) and a simple arrange – you possibly can profit* from a RSP.

So begin investing at the moment, even whether it is simply $200 a month.

Your future self will thanks.

*Observe: RSPs are nonetheless topic to funding dangers. Necessary Observe: Month-to-month funding plans in Singapore are all custodised accounts. Which means that the shares might be held underneath FSMOne and never in your individual CDP account, nonetheless, you possibly can all the time pay a switch of the shares to your CDP account if you want.

Disclosure: This text is dropped at you in collaboration with Nikko Asset Administration Asia Restricted. All calculations and opinions are that of my very own. Nothing on this publish is to be constituted as monetary recommendation since I have no idea the main points of your private circumstances. You're inspired to learn extra about RSPs on MAS-licensed suppliers together with FSMOne and Nikko Asset Administration that will help you perceive and determine on how an RSP can match into your funding aims. Info is correct as of three October 2023.

Necessary Info by Nikko Asset Administration Asia Restricted: This doc is only for informational functions solely without any consideration given to the particular funding goal, monetary state of affairs and specific wants of any particular particular person. It shouldn't be relied upon as monetary recommendation. Any securities talked about herein are for illustration functions solely and shouldn't be construed as a suggestion for funding. It's best to search recommendation from a monetary adviser earlier than making any funding. Within the occasion that you just select not to take action, it is best to take into account whether or not the funding chosen is appropriate for you. Investments in funds usually are not deposits in, obligations of, or assured or insured by Nikko Asset Administration Asia Restricted (“Nikko AM Asia”). Previous efficiency or any prediction, projection or forecast isn't indicative of future efficiency. The Fund or any underlying fund could use or spend money on monetary spinoff devices. The worth of models and earnings from them could fall or rise. Investments within the Fund are topic to funding dangers, together with the attainable lack of principal quantity invested. It's best to learn the related prospectus (together with the chance warnings) and product highlights sheet of the Fund, which can be found and could also be obtained from appointed distributors of Nikko AM Asia or our web site (www.nikkoam.com.sg) earlier than deciding whether or not to spend money on the Fund. The data contained herein is probably not copied, reproduced or redistributed with out the specific consent of Nikko AM Asia. Whereas affordable care has been taken to make sure the accuracy of the data as on the date of publication, Nikko AM Asia doesn't give any guarantee or illustration, both specific or implied, and expressly disclaims legal responsibility for any errors or omissions. Info could also be topic to vary with out discover. Nikko AM Asia accepts no legal responsibility for any loss, oblique or consequential damages, arising from any use of or reliance on this doc. This commercial has not been reviewed by the Financial Authority of Singapore. Nikko Asset Administration Asia Restricted. Registration Quantity 198202562H.

[ad_2]