[ad_1]

*Set off warning for shopaholics*

Expensive readers, collect ’spherical, and let me take you on a journey by way of the aisles of on-line buying, the place the siren name of “Add to Cart” beckons even essentially the most frugal souls. Sure, we’re diving into the realm of impulse shopping for and I promise you, it’s eerily irresistible.

Image this: You’re in your pyjamas, nestled within the cosy cocoon of your favorite blanket, a steaming cup of cocoa in hand and your laptop computer display illuminating your keen face. You innocently open your internet browser, intending to purchase only a single merchandise—a humble guide, maybe. However earlier than it, you’ve fallen right into a buying vortex, the place you’re haunted by irresistible offers, reductions and a seemingly countless array of merchandise. It’s like being lured into an eerie, on-line retail haunted home.

On-line buying portals – the modern-day Pandora’s field – is designed to be irresistible. They know what you want, what you’ve purchased earlier than and what you’re more likely to buy subsequent. However beware, for this comfort is a double-edged sword. They bombard you with strategies, drawing you deeper into the abyss. It’s nearly as if they’ve employed some sort of digital sorcery to learn your thoughts.

With a click on right here and a click on there, the ghosts of one-click buying hang-out our wallets. It’s all really easy. You see a product you want and earlier than it, it’s on its manner to the doorstep. However bear in mind, what’s simple in your fingers generally is a actual scare on your funds. Don’t let the ghost of “FOMO” (Worry of Lacking Out) possess you!

Let’s discover the intriguing realm of impulse shopping for. It’s as if mischievous little entities sneak into your buying cart, slyly introducing merchandise you by no means knew you wanted. It begins innocently sufficient. You click on on a product you’re genuinely taken with and out of the blue, a pop-up suggests, “Individuals who purchased this additionally purchased…”, and similar to that, your cart fills up with objects you by no means knew you couldn’t stay with out.

Typically, you may end up pondering, “Do I really want this Jimi Hendrix wig for my cat?” or “Is a 24-pack of rainbow-colored brush pens a vital a part of adulting?” The reply might be no, however your thoughts has a manner of creating you suppose in any other case.

One of many scariest facets of on-line buying is the ghostly reappearance of previous purchases. You suppose you’ve put a product to relaxation in your buy historical past, however the web site has different plans. It continues to hang-out you with reminders of your earlier buying sprees, nearly taunting, “Keep in mind how comfortable this stuff made you? Need extra of that?”

These digital apparitions could make you’re feeling like Scrooge being visited by the ghosts of Christmas previous.

Impulse shopping for usually results in purchaser’s regret and that’s a ghost that lingers. You’ve unboxed your newest buy and out of the blue, it doesn’t appear as magical because it did on the display. That’s when the eerie realisation units in – you’ve spent your hard-earned cash on one thing you actually didn’t need or want.

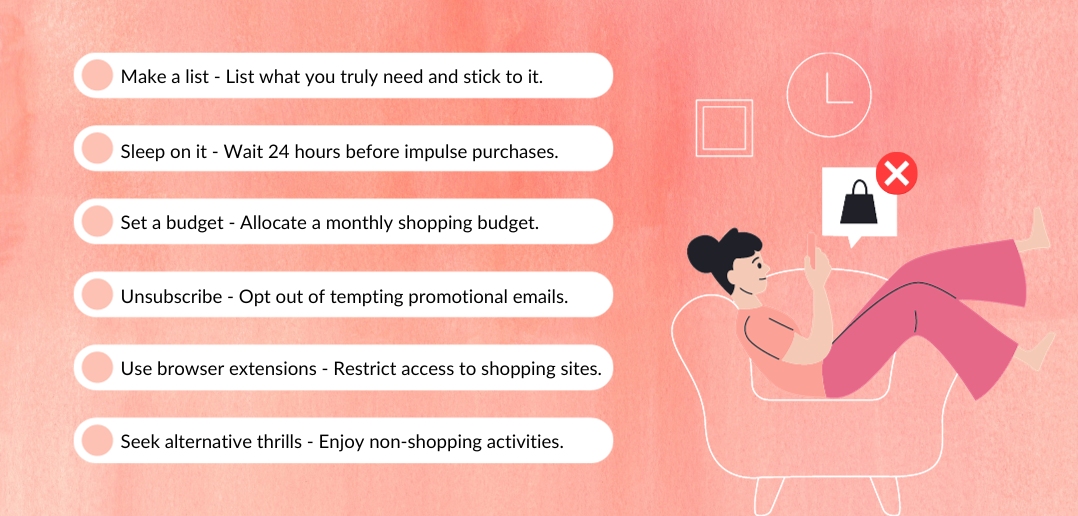

Listed here are some methods that will help you keep away from falling below their spell:

- Make an inventory: Earlier than you begin looking, make an inventory of what you really need. Follow it as in case your monetary future depends upon it (as a result of it does).

- Sleep on it: For those who see one thing that tickles your fancy, await not less than 24 hours earlier than making the acquisition. This may allow you to separate real needs from fleeting impulses. Use that “Save for Later” possibility successfully.

- Set a price range: Allocate a particular sum of money for on-line buying every month. As soon as it’s gone, it’s gone.

Extra Studying: Franken-finance: Piecing Collectively A Funds That Gained’t Scare You!

- Unsubscribe from promotional emails: These emails are like siren calls. Unsubscribe and save your self from temptation.

- Use browser extensions: There are browser extensions that may block or restrict your entry to buying web sites throughout sure occasions. They’re just like the digital equal of garlic to vampires.

- Search various thrills: Discover different actions that convey you pleasure and satisfaction. An excellent guide, a protracted drive or perhaps a cooking experiment can provide fulfilment with out the aftertaste of purchaser’s regret.

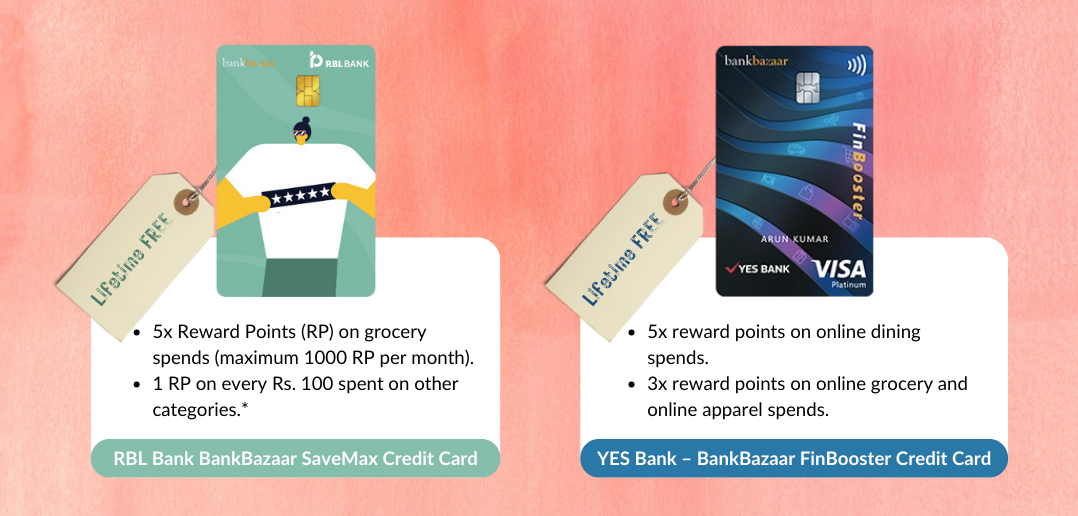

Credit score Playing cards, with their buying energy, could be your secret weapon towards impulse shopping for. They will help you tame the attract of on-line buying. Right here’s how:

- Card Controls: Card controls are a useful function for bolstering your monetary safety and sustaining strict management over your spending. They allow you to tailor your Credit score Card utilization to your exact wants by limiting card utilization to particular kinds of retailers and setting transaction limits.

- Assertion Overview: Credit score Card statements mirror your buying selections. Recurrently reviewing your statements helps you observe your spending and determine these impulsive purchases.

- Rewards and Cashback: Some Credit score Playing cards provide cashback, rewards or reductions on particular purchases. These incentives generally is a motivating issue to make deliberate, aware purchases as an alternative of falling into the impulse-buying entice.

Extra Studying: 7 Lesser-Identified Perks Of Credit score Playing cards

- Emergency Fund: Credit score Playing cards could be your monetary lifeline throughout emergencies. By saving your card for these vital conditions, you’ll be much less tempted to make use of it for frivolous on-line buying escapades.

- Accountable Spending: Constructing a optimistic credit score historical past and sustaining a great Credit score Rating require accountable spending. This implies utilizing your Credit score Card correctly and paying your payments on time, which might deter you from impulsive purchases.

- Expense Calculator: Use a cellular app to trace and categorise your spends each month. Once you see simply how a lot these tiny impulse on-line purchases add as much as, you’ll be taught to spend extra judiciously.

Within the eerie-sistible world of on-line buying, impulse shopping for generally is a formidable adversary. It tempts you with phantom sale costs, ghostly algorithms and the consolation of retail remedy. However, armed with the best information and techniques, you possibly can exorcise these spending demons out of your life.

In conclusion, Credit score Playing cards, when used correctly, could be your ghostbusters, serving to you keep management over your spending and chase away impulse-buying demons. So, the subsequent time you end up navigating the eerie aisles of on-line buying, bear in mind the facility of your trusty Credit score Card and slay these temptation monsters. It’s your cash, your selections – the facility to hang-out or be haunted lies firmly in your arms.

Pleased buying, fellow hunters of nice offers! Might your on-line carts be eternally freed from impulse purchases!

Copyright reserved © 2023 A & A Dukaan Monetary Providers Pvt. Ltd. All rights reserved.

[ad_2]