[ad_1]

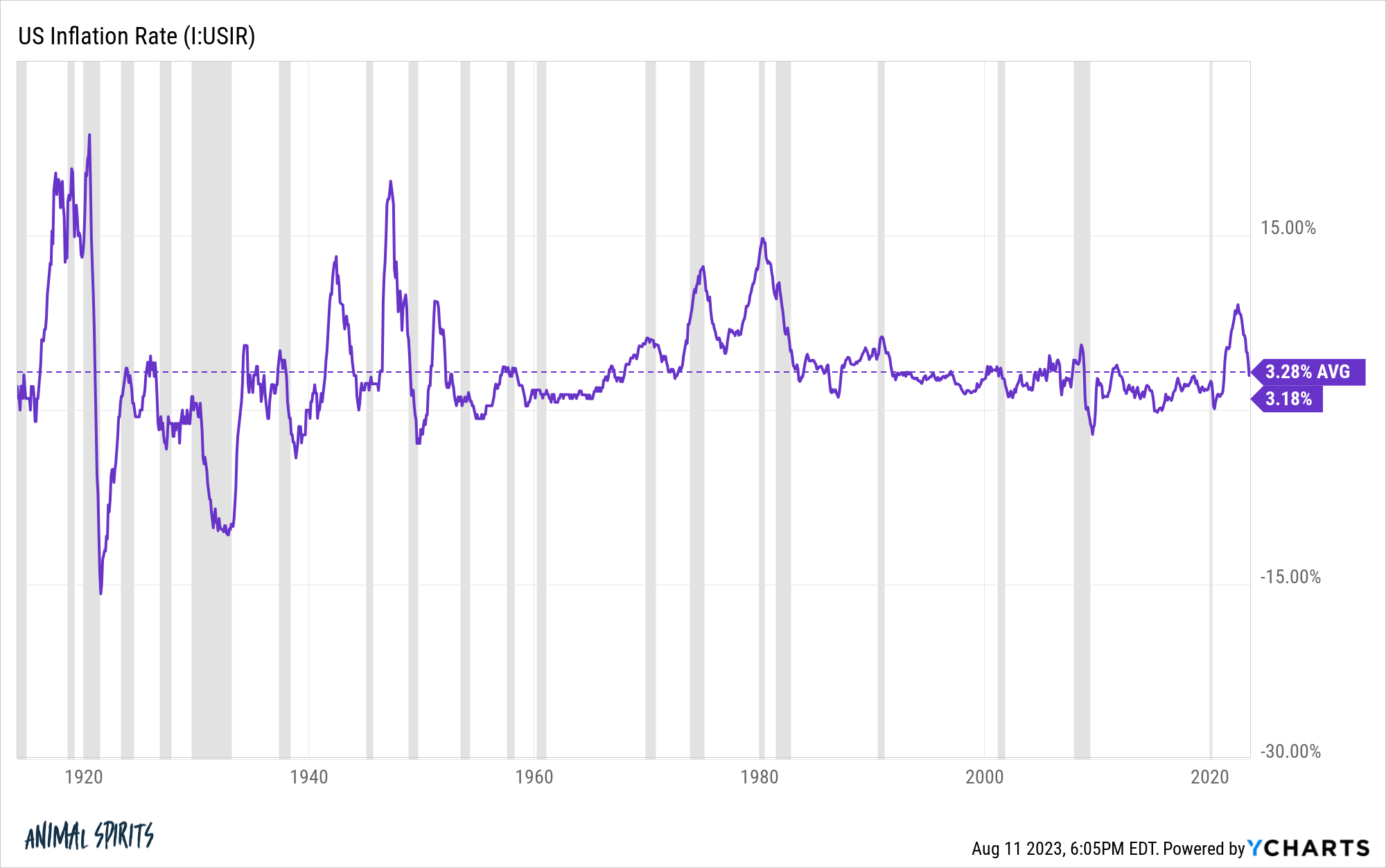

After 12 months in a row of falling annualized inflation numbers, the most recent studying ticked barely increased this month.

Listed here are these numbers from the height in June 2022:

- 9.06%

- 8.52%

- 8.26%

- 8.20%

- 7.75%

- 7.11%

- 6.45%

- 6.41%

- 6.04%

- 4.99%

- 4.93%

- 4.05%

- 2.97%

- 3.18%

For some time there stagflation was all the trend. That danger subsided comparatively shortly because the financial system remained sturdy and the stag a part of that equation fell by the wayside.

Loads of individuals are nonetheless nervous a couple of potential recession (and doubtless at all times will probably be) however the brand new danger is the potential for an overheating financial system from the continued energy of each the patron and the labor market.

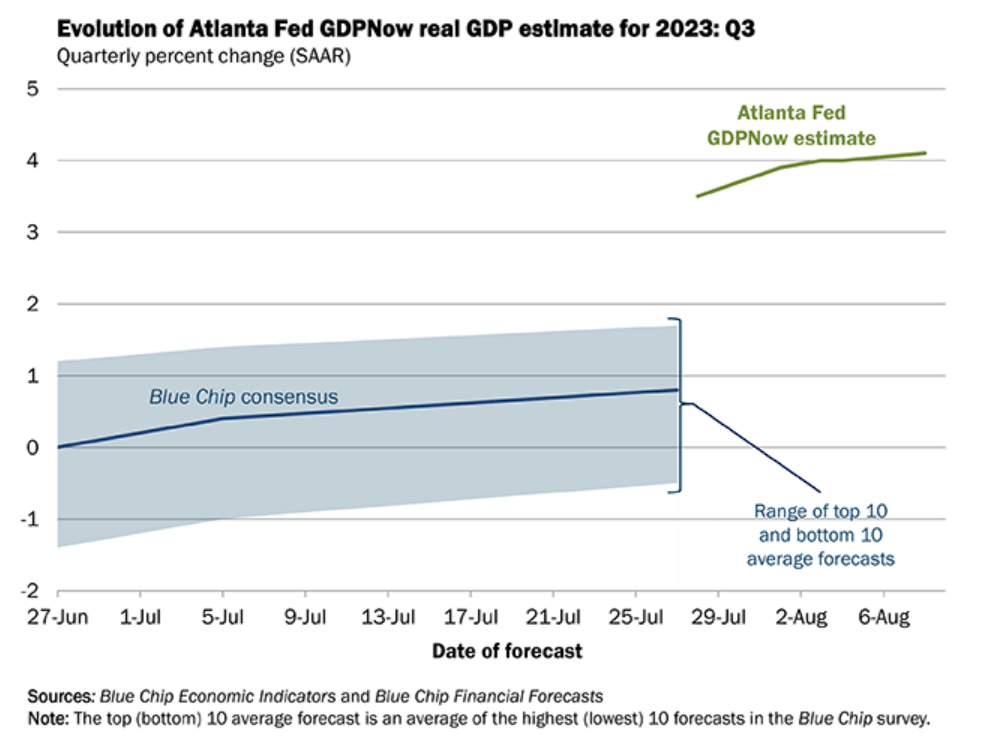

Simply have a look at the Atlanta Fed’s GDPNow forecasting mannequin for the upcoming quarter:

They’re actual GDP development of greater than 4%.

On this financial system?!

It needs to be famous that the Atlanta Fed can’t see the long run higher than anybody else. Economists aren’t any higher than you or me at forecasting what comes subsequent with the financial system.

However it’s true that the financial system has remained hotter than nearly anybody thought doable at this level within the cycle.

Everybody thought we’d be in a recession already however right here we’re.

It appears unusual to fret about increased inflation whereas it’s been falling so precipitously however a re-acceleration in inflation is a giant danger issue proper now for the markets.

The large fear is that if inflation stays elevated above the Fed’s 2% goal they must proceed elevating charges till the financial system goes right into a recession.

My competition is that this: why are we anchored to this arbitrary 2% determine if unemployment stays low and wages are rising?

Isn’t 3-4% inflation on this situation a greater consequence than a recession that brings inflation again all the way down to 2%?

Right here’s the long-term common over the previous 110 years or so:

Clearly, value ranges had been much more risky within the early-Twentieth century however the long-run common is a bit more than 3%.

Is that actually so dangerous if that’s what we settle into?

That is what query I posed to Bob Elliott this week on The Compound and Associates (across the 40-minute mark):

Elliott primarily informed us the fear with permitting inflation to run increased than regular is that it introduces the potential for extra volatility in value ranges, which has occurred traditionally.

Inflation itself isn’t nice however frequent modifications are what make it so tough for households and companies to make longer-term choices for spending and investments.

If inflation was 5% however everybody knew it might be 5% for the foreseeable future, that’s one thing we might all stay with for planning functions.

If inflation cools off, then will get sizzling once more and stays risky that’s going to make issues tough.

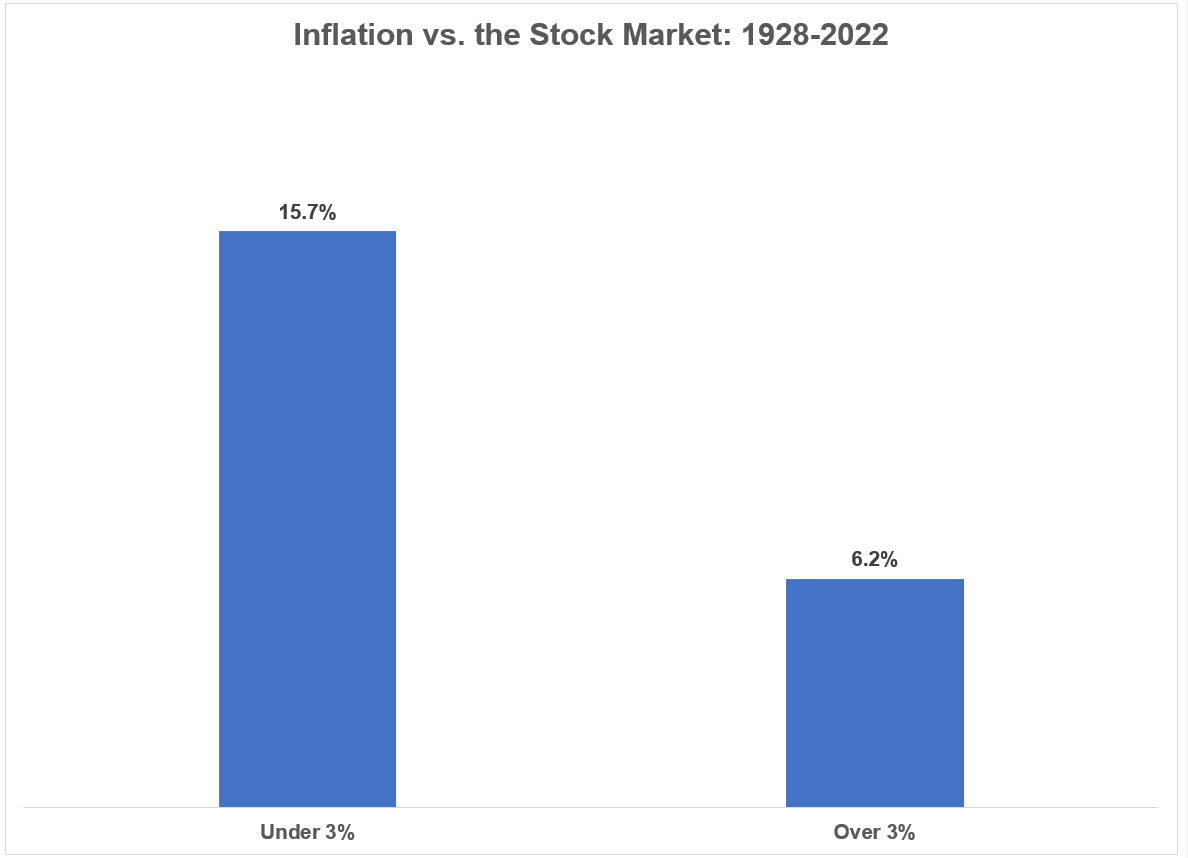

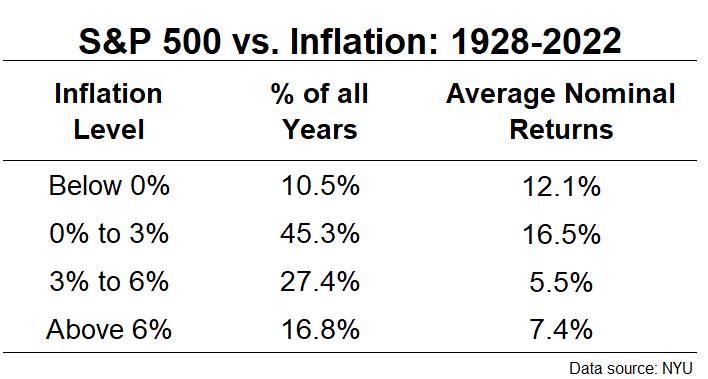

I don’t know if above-target inflation will trigger a mass change in psychology for companies and households however the historical past of inventory market returns reveals returns are typically decrease when inflation is above common.

Here’s a have a look at common annual returns for the S&P 500 when inflation is above and under 3%:

The inventory market has skilled above-average returns when inflation was below-average and below-average returns when inflation was above-average.

Right here’s an additional breakdown by totally different ranges that tells the identical story:

Increased inflation doesn’t assure decrease inventory market returns however it is smart why fairness buyers aren’t thrilled with a rise in financial volatility.

Whereas client sentiment isn’t happy with financial volatility resembling inflation, the previous few years have had some unintended advantages.

Typically volatility may be useful in that it shakes up the established order.

Let’s have a look at some latest information that reveals how the financial craziness has improved the fortunes of sure teams of individuals.

Right here’s a story that led to loads of memes this week about UPS drivers:

UPS drivers will earn a median of $170,000 in pay and advantages on the finish of a five-year contract their union negotiated with the provider final month to avert a strike, UPS CEO Carol Tomé mentioned throughout an earnings name this week.

The deal, which was reached on July 25, will improve full-time employees’ compensation to $170,000 from roughly $145,000 over 5 years, in response to UPS’ calculations. It would additionally increase part-time employees’ salaries to at the very least $25.75 per hour and finish obligatory time beyond regulation, Tomé informed buyers on Tuesday.

Not dangerous.

A decent labor market offers employees much more leverage than me threatening to cancel my cable yearly simply to get a greater deal (works each time).

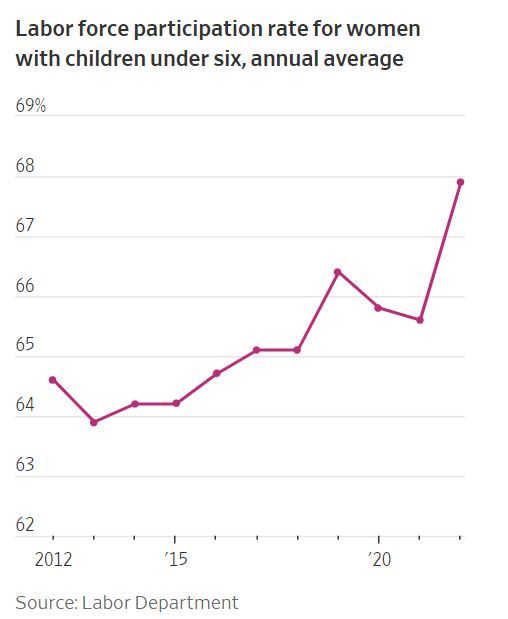

Or how about this chart from the Wall Avenue Journal:

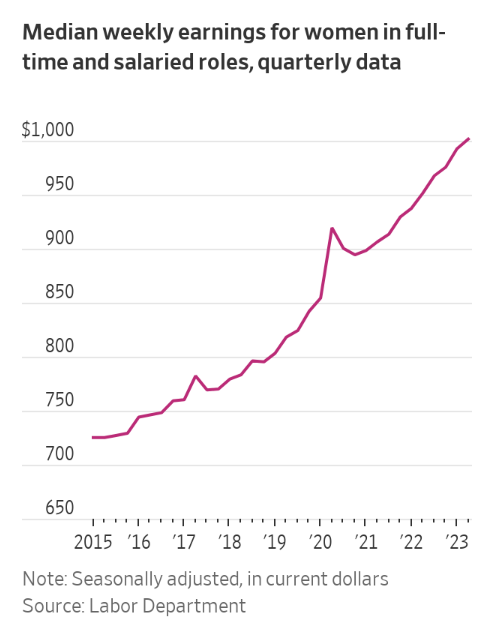

And one other one:

I bear in mind when a giant fear through the pandemic was ladies within the workforce who had been going to be pressured to stop their jobs due to faculty closures and an absence of kid care.

Right here’s some extra information on the labor pressure from The Washington Submit:

The U.S. financial system is within the midst of an exquisite — and sudden — workforce growth. Greater than 3.1 million employees joined the labor pressure previously yr, which means these individuals began on the lookout for jobs and, largely, are getting employed. Nearly nobody anticipated this. It’s a virtually 2 p.c growth of the labor pressure — one thing that has not occurred for the reason that tech craze of July 1999 to July 2000 and was extra widespread within the Seventies and Nineteen Eighties.

Ladies are driving this labor pressure growth. With rising pay and extra flexibility to make money working from home or modify their hours, they’re surging into the workforce. Labor pressure participation for ladies ages 25 to 54 hit an all-time excessive this summer time, far surpassing pre-pandemic ranges. There are particularly sturdy features for moms of younger kids. The sectors on hiring sprees these days — well being care, social help and authorities — are additionally ones the place ladies have traditionally discovered probably the most alternatives. The result’s ladies now make up half of all U.S. staff. That milestone was reached solely twice earlier than in trendy U.S. historical past: simply earlier than the pandemic, and in 2009 after the Nice Recession destroyed so many “muscle jobs.”

I’m not right here to argue that inflation has been a superb factor.

Earlier than you ship me any hate mail, I do know not everybody’s wages have saved up with inflation because it took off.1

Many individuals are struggling.

However individuals had been additionally struggling within the 2010s when inflation was low, inequality was uncontrolled and wage development was gradual.

There isn’t an financial surroundings in existence that helps everybody equally. As my mom used to at all times remind me once I was a child, “Life isn’t truthful.”

Each financial cycle will probably be good for some and dangerous for others.

I are inclined to suppose the present state of affairs is significantly better than most individuals understand and will probably be regarded upon as favorable sooner or later, regardless that it hasn’t been a stroll within the park.

However I additionally agree {that a} re-acceleration in inflation is a large potential danger for the markets and the financial system.

In that situation, some will profit whereas others will battle.

Sadly, there are at all times going to be trade-offs in this stuff.

There isn’t a financial system that makes everybody pleased on the similar time.

Additional studying:

Inflation vs. Wages

1Though, if we return to the beginning of this decade in 2020, wages really are outpacing inflation. Common hourly earnings are up 21.5% this decade whereas CPI has risen roughly 19%. It’s actually solely since 2021 that inflation has overwhelmed inflation.

[ad_2]