[ad_1]

Friday Might 12 we had the annual Hoover financial coverage convention. Hoover twitter stream right here. Convention webpage and schedule right here (replace 5/24 now comprises movies.) As earlier than, the talks, panels, and feedback will finally be written and revealed.

The Fed has skilled two dramatic institutional failures: Inflation peaking at 8%, and a rash of financial institution failures. There have been panels targeted on every, and far surrounding dialogue.

We began with slightly celebration of the thirtieth anniversary of Taylor (1993), which put the Taylor rule on the map. As Andy Levin identified within the dialogue, educational immortality comes after they omit the quantity after your identify. Wealthy Clarida, Volker Weiland and I rapidly outlined some educational affect. John Lipsky added some very attention-grabbing commentary on how the Taylor rule was essential on Wall Avenue, and particularly from his expertise at Salomon Bros.

The second panel on monetary regulation was a smash. Anat Admati chaired, with displays by Darrell Duffie, Randy Quarles, and Amit Seru.

Duffie confirmed how on-line banking has taken over, and the mix of twitter and on-line banking makes runs occur a lot sooner than earlier than. You do not have to face in line, you possibly can all push “withdraw” directly. He additionally confirmed a obvious gap in liquidity rules: A financial institution can not rely as liquidity its capability to make use of the low cost window on the Fed.

Seru coated a few of his current work, displaying simply what number of banks have misplaced 10% or extra of their asset worth, and thus the worth of their fairness. (No one talked about business actual property, the subsequent shoe to drop.) They gently disagreed, Darrel viewing extra liquidity and higher liquidity guidelines as the principle resolution, and Amit extra fairness. All appeared to agree that the present regulatory mechanism is basically damaged.

Randy gave a considerate, eloquent, and impassioned speak laying to relaxation the frequent notion that “deregulation” induced SVB to fail. It could have handed all of the stress checks. This will likely be essential to learn when the papers are all obtainable. I take the implication that the regulatory construction is, once more, basically damaged. No, extra of the present rules wouldn’t have helped. However Randy did not say that.

Peter Henry subsequent introduced “Disinflation and the Inventory Market: Third World Classes for First World Financial Coverage” (a paper with Anusha Chari), mentioned by Josh Rauh and Chaired by Invoice Nelson. A key innovation, they use inventory market reactions to measure whether or not disinflations are a hit on a value/profit foundation. Giant inflations appear to finish with inventory market expansions. Average disinflations do not actually do a lot for inventory markets. Most disinflationary reforms fail.

Over lunch, Haruhiko Kuroda, Former Governor, Financial institution of Japan up to date us on the Japanese state of affairs. He’s assured 2% inflation will return quickly.

Niall Ferguson and Paul Schmelzing introduced “The Security Internet: Central Financial institution Stability Sheets and Monetary Crises 1587-2020,” (with Martin Kornejew and Moritz Schularick), with Barry Eichengreen discussing and Michael Bordo chair. A style:

The paper concludes that lender of final resort operations do work, and in addition create ethical hazard. Barry had an eloquent dialogue, noting amongst different issues that not all stability sheet expansions are the identical. Search for these within the written variations.

To me, it seems to be just like the forecast isn’t far more than an AR(1) reversion to 2% inflation. The paper has a great abstract of how Fed forecasts are made, together with suggestions for institutional enchancment.

Steve Davis had a wonderful dialogue, pointing to a central incentive drawback. The Fed makes use of forecasts to attempt to form expectations. Like pubic well being authorities, it may be afraid to disclose precise fears. I additionally see conceptual flaws — not a lot consideration to produce or fiscal coverage, utilizing the Phillips curve as a causal mannequin and as a mannequin in itself, an excessive amount of consideration to the one-period hyperlink from anticipated inflation to inflation, and an excessive amount of consideration to the forecast slightly than threat administration; what can we do if issues come out otherwise.

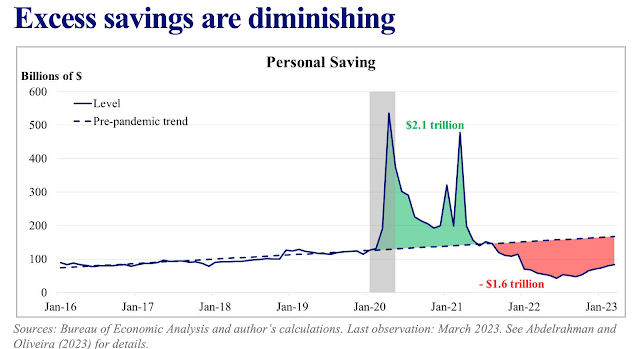

Bullard pointed to the massive fiscal stimulus as a supply of inflation, warming my coronary heart. He opined that this stimulus is fading, making him looking forward to a mushy touchdown. He introduced the next chart.

It is a very attention-grabbing measure of how a lot “stimulus” is sitting on the market within the economic system. The federal government did write numerous checks, that went straight to individuals’s financial institution accounts, and finally have been spent, driving up inflation. However, I’m nonetheless a bit shocked that we’re working $1 trillion deficit regardless of beyond-full employment and output revving at each bit that the “provide” facet of the economic system can produce. What’s your measure of fiscal stimulus? Which forecasts inflation? It is a very provocative and attention-grabbing concept.

Jefferson gave an awesome speak. He has the measured cadence of a seasoned central banker, however speaks very clearly and immediately. He began by saying his appointment as vice-chair, which bought a effectively deserved ovation. He then jumped proper in:

The title of the convention “The best way to Get Again on Observe: A Coverage Convention” is potent. Its intent and ambiguity are placing. First, the title presupposes that U.S. financial coverage is presently on the unsuitable observe. Second, the webpage for this convention advances a puzzling definition of the phrase “on observe.” How so? In accordance with the Hoover webpage, “A key purpose of the convention is to look at how you can get again on observe and, thereby, how you can cut back the inflation price with out slowing down financial development” (emphasis added).1 As this viewers is aware of, there are macroeconomic fashions that let disinflation with no slowdown in financial development, however the assumptions underlying these fashions are very robust. It is not clear, at the least to me, why such a strict metric could be used to evaluate real-world financial policymaking….

I beloved this. It reveals he took the time to learn up on the convention, and I really like seeing fundamental premises challenged. Later, this struck me as considerate:

I wish to share with you just a few strategic ideas which might be essential to me. First, policymakers needs to be able to react to a variety of financial circumstances with respect to inflation, unemployment, financial development, and monetary stability. The unprecedented pandemic shock is an efficient reminder that beneath extraordinary circumstances it is going to be tough to formulate exact forecasts in actual time. Our twin mandate from the Congress is very useful right here. It gives the muse for all our coverage choices. Second, policymakers ought to clearly talk financial coverage choices to the general public. Our dedication to transparency needs to be evident to the general public, and financial coverage needs to be carried out in a method that anchors longer-term inflation expectations. Third—and that is the place I’m revealing my ardour for econometrics—policymakers ought to repeatedly replace their priors about how the economic system works as new information change into obtainable. In different phrases, it’s applicable to vary one’s perspective as new details emerge. On this sense, I’m in favor of a Bayesian method to info processing.

The primary level brings us again to the issue that the Fed has up to now been too silent about: How did it miss 8% inflation? And how you can function when such enormous misses are potential? The Fed appears to have been making a forecast, then saying a coverage path that works for the forecast, after which attempting to stay to it. On this first precept you see a fairly totally different view. Let’s name it data-dependent slightly than time-dependent.

It is a convention in regards to the Taylor rule. Ought to the Fed take a look at greater than inflation and employment? Effectively, sure and no in response to these feedback. And when fashions should not sure, mistrust and replace.

Plosser and Lacker previewed an upcoming paper on the Fed’s deviation from guidelines. Keep tuned.

The night began with a pleasant speech by Sebastian Edwards on Latin American inflation. Keep tuned for that too.

Movies needs to be up quickly, and written variations as quick as we are able to get authors to show them in. That is only a teaser!

[ad_2]