[ad_1]

House insurance coverage and residential guarantee…they sound comparable and even look like they imply the identical factor, however there are literally some fairly large variations.

Learn on to be taught extra about a few of the larger variations between dwelling insurance coverage and residential guarantee plans and the way they could possibly be useful to you and your property.

Let’s begin with the fundamentals.

House insurance coverage offers protection for:

- Your construction(s), similar to your private home, storage, deck, sheds, and many others.

- Your private belongings, similar to furnishings, clothes and jewellery (topic to particular person coverage limitations)

- Your legal responsibility, which covers damages to others for which you’re liable

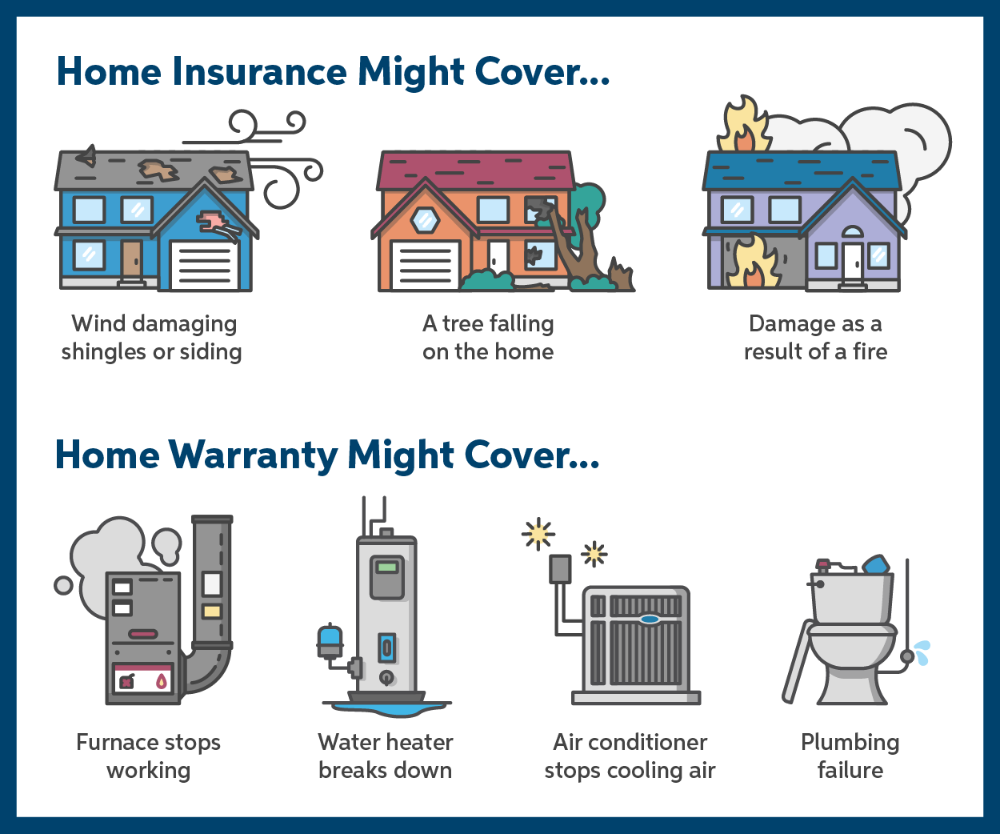

One factor that isn’t sometimes coated by a fundamental dwelling insurance coverage coverage is “put on and tear.” This may be complicated as many would assume that if an merchandise wears out, it is going to be coated by their insurance coverage. However, for insurance coverage, the harm must be “sudden and unintentional,” similar to wind, tree and fireplace harm.

harm must be “sudden and unintentional,” similar to wind, tree and fireplace harm.

Some insurance coverage carriers provide add-on coverages that may be utilized to a fundamental dwelling insurance coverage coverage, which might cowl some kinds of “put on and tear” exposures. House insurance coverage and its coverages can fluctuate enormously from firm to firm and even coverage to coverage. Working with an impartial agent will assist be certain that all of the coverages you want are added to your coverage.

So, what does a house guarantee cowl?

A house guarantee normally covers damages to home equipment and residential techniques that may be anticipated similar to:

- Furnace stops working

- Water heater breaks down

- Air conditioner stops cooling air

- Plumbing failure

Not like dwelling insurance coverage, a house guarantee doesn’t cowl the precise dwelling or buildings on the location regardless of the title sounding prefer it’s a guaranty for the house itself. Quite, it’s normally a guaranty for sure issues which can be inside or part of the house.

There are cases the place protection might overlap between dwelling insurance coverage and a house guarantee – particularly if a house insurance coverage coverage has particular coverages added to it. For instance, say you might have a fundamental dwelling insurance coverage coverage and a fundamental dwelling guarantee as properly – in case your furnace is previous and stops working, it could possibly be coated by the house guarantee because it was previous and anticipated to have points.

Nonetheless, let’s say that as a result of the furnace died, your pipes by accident froze and there was water harm to your private home. This water harm, because it was sudden and unintentional, could possibly be coated by your private home insurance coverage coverage. If elective coverages have been added to the house insurance coverage coverage, the entire occasion could possibly be coated by that coverage alone.

We get it. It’s complicated. To assist illustrate these variations, right here’s a helpful graphic:

Protection limits for each dwelling insurance coverage and residential guarantee insurance policies fluctuate relying on particular person wants. A bigger home with complicated dwelling techniques may have increased limits than a smaller dwelling with minimal dwelling system exposures.

Protection limits can have a big impression on general premiums, so particular person insurance policies and plans ought to be reviewed intently by an agent and the shopper to ensure that the fitting safety is in place.

When unsure, name your native, Bolder Insurance coverage impartial agent.

They’re right here to make insurance coverage easy.

[ad_2]