[ad_1]

You’ll have heard the phrase mortgage fee lock-in impact currently.

As a fast refresher, it’s a house owner’s unwillingness to surrender an ultra-low mortgage fee for a a lot greater one.

Or just the lack to surrender their low fee, as qualifying for a house buy at in the present day’s a lot greater charges can be an impossibility.

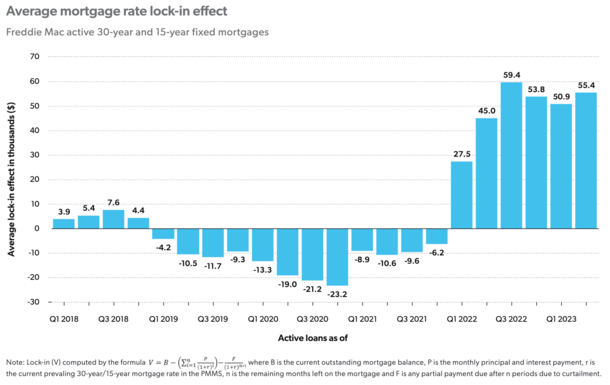

Regardless, there’s now a price assigned to this so-called mortgage fee lock-in impact, with Freddie Mac placing the typical at about $55,000.

This implies an present house owner wants a giant incentive to promote, until they wish to forgo that worth.

How Invaluable Is Your Low Mortgage Fee?

Freddie Mac reported that six out of 10 debtors now have a mortgage fee at or under 4%.

And that the mortgage fee lock-in impact is a profit to owners who maintain fixed-rate mortgages.

Now everybody is aware of a low mortgage fee can prevent cash, because of a decrease month-to-month cost.

Nevertheless it additionally carries worth, which may ebb and stream primarily based on prevailing market charges. By no means has this been more true than the final yr and alter.

Merely put, mortgage charges greater than doubled from their report low ranges in 2021.

Consequently, those that locked in low charges round that point now maintain one thing extraordinarily precious.

For perspective, the 30-year fastened hit its all-time low of two.65% in early January 2021, per Freddie Mac.

Final week, it averaged a considerably greater 6.78%, which is a greater than 150% enhance.

Except for making a world of haves and have nots, it has made transferring much more troublesome for many who want a mortgage to purchase a house.

Even in case you can qualify at a a lot greater rate of interest, do you wish to surrender your low fee?

It’s not as if house costs have come down, so that you’re merely buying and selling your previous low fixed-rate mortgage for a brand new one which’s rather more costly.

However how a lot would you “lose” in case you did? Nicely, now we would know.

Figuring out the Worth of Mortgage Fee Lock-In

Due to some daunting math, this worth has now been quantified by Freddie Mac economists.

They decide the worth of mortgage fee lock-in by taking the distinction between the excellent steadiness of the mortgage and the current worth of the mortgage at prevailing market rates of interest.

Of their instance, a “fortunate house owner” will get the chance to refinance their mortgage at 2.65% in January 2021.

Their $250,000 mortgage quantity can be whittled all the way down to about $236,379 after 29 months, with a ridiculously low principal and curiosity cost of $1,007.

Now supposing they wished to promote and transfer elsewhere in the present day, they’d be taking a look at a comparable mortgage fee nearer to 7%.

Assuming an identical mortgage quantity, the month-to-month P&I’d bounce to greater than $1,500 per 30 days.

This hypothetical instance places the worth of mortgage fee lock-in at a large $86,136.

Put one other method, they’d want a near-$90,000 motive to maneuver, whether or not it was for a a lot better job, lifestyle, and so on.

In any other case, they’d want to remain put, which seems to be the most typical consequence for the time being given the dearth of present housing stock.

Your Mortgage Fee Lock-In Worth Might Fluctuate

The Freddie Mac economists famous that the typical worth of mortgage fee lock-in “varies significantly” because of area and yr of origination.

For instance, it’s simply $32,000 in West Virginia, however a whopping $91,000 in Hawaii.

And those that took out mortgages in 2020 and 2021 have a median mortgage fee lock-in worth of $77,000 and $85,000, respectively.

What’s maybe extra shocking is even those that took out a house mortgage in 2023 have a median mortgage fee lock-in worth of $10,000.

Total, owners with fixed-rate mortgages financed by Freddie Mac (30-year and 15-year fastened loans) have locked in a collective $700 billion {dollars} in complete worth.

This complete is the same as about 25% of Freddie Mac’s single-family mortgage portfolio’s unpaid principal steadiness.

It tells you why this phenomenon is so impactful, and why there’s a main lack of obtainable for-sale stock for the time being.

Whereas this can dampen house gross sales and mortgage originations, it ought to assist prop up house costs at a time when affordability has not often been worse.

Freddie Mac mentioned its official company forecast for the subsequent 12 months has house costs falling by 2.9%, adopted by one other 1.3% annual decline.

However given present market circumstances (and an early learn on their knowledge), they count on an upward revision.

In brief, they foresee continued tight stock due in no small half to this lock-in impact, which ought to preserve gross sales quantity down however costs up.

Learn extra: Will mortgage charges go down for the remainder of 2023?

[ad_2]