[ad_1]

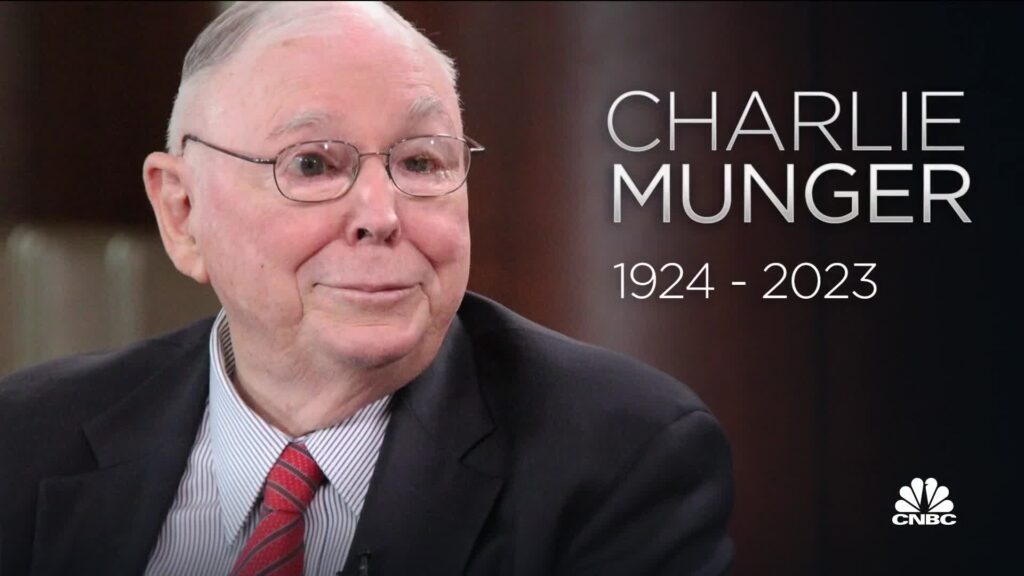

The world misplaced a lightweight this morning.

I woke as much as unhappy information this morning after I examine Charlie Munger’s passing on the age of 99. As somebody who has enormously impressed and influenced me in each my life and my investing journey, Munger’s phrases and interviews are stuffed with knowledge and I encourage you to dive into his works if you happen to haven’t already accomplished so.

So for my tribute to Charlie Munger, I’ve consolidated my favorite classes and quotes of his to share.

Often known as Warren Buffett’s right-hand man at Berkshire Hathaway, Charlie Munger was a person of wit and knowledge, and I discovered lots from following his writings and interviews through the years. One fond reminiscence I’ve was throughout the 2021 Berkshire annual shareholder assembly – which I used to be watching and overlaying stay (on my Instagram Tales) – laughing when he inadvertently let slip that Berkshire Hathaway could be succeeded by Greg Abel (at the moment, it was nonetheless a tightly-kept secret as to who Buffett’s successor could be). The seems on everybody’s faces then was pure gold.

Ahhh, good ol’ Charlie.

For many people buyers, Charlie Munger will perpetually be remembered as one of many “nice sages”, and whom we are able to be taught (and I’ve learnt) a lot from. Right here’s a few of the most significant ones which have formed my life:

The key to an incredible life

“It’s so easy: you spend lower than you earn. Make investments shrewdly. Keep away from poisonous folks and poisonous actions. Attempt to continue learning all of your life. And do quite a lot of deferred gratification.

If you happen to do all these issues, you might be virtually sure to succeed. And if you happen to don’t, you’ll want quite a lot of luck. And also you don’t need to want quite a lot of luck.

Guidelines for a cheerful and profitable profession

“Three guidelines for a profession: (1) Don’t promote something you wouldn’t purchase your self; (2) Don’t work for anybody you don’t respect and admire; and (3) Work solely with folks you get pleasure from.”

“The easiest way to get what you need in life is to deserve what you need. It’s such a easy thought. It’s the golden rule. You need to ship to the world what you’d purchase if you happen to have been on the opposite finish.

“There isn’t a ethos for my part that’s higher for any lawyer or some other individual to have. By and enormous, the individuals who’ve had this ethos win in life, they usually don’t win simply cash and honours. They win the respect, the deserved belief of the folks they cope with. And there’s large pleasure in life to be obtained from getting deserved belief.”

On easy methods to deal with issues

“I simply attempt to keep away from being silly. I’ve a method of dealing with quite a lot of issues — I put them in what I name my ‘too arduous pile,’ and simply depart them there. I’m not making an attempt to achieve my ‘too arduous pile.’”

Be quick to acknowledge and admit errors

“There’s no method that you would be able to stay an ample life with out many errors. In truth, one trick in life is to get so you’ll be able to deal with errors. Failure to deal with psychological denial is a standard method for folks to go broke.”

“The flexibility to destroy your concepts quickly as an alternative of slowly when the event is correct, is likely one of the most precious issues. It’s a must to work arduous on it.

“Ask your self what are the arguments on the opposite aspect. It’s unhealthy to have an opinion you’re pleased with if you happen to can’t state the arguments for the opposite aspect higher than your opponents. It is a nice psychological self-discipline.”

Each blow in life is a chance to be taught and enhance

“One other factor, in fact, is life can have horrible blows, horrible blows, unfair blows. Doesn’t matter. And a few folks get well and others don’t. And there I believe the perspective of Epictetus is the very best. He thought that each mischance in life was a possibility to be taught one thing and your responsibility was to not be submerged in self-pity, however to make the most of the horrible blow in a constructive style.”

“You must by no means, when confronted with one unbelievable tragedy, let one tragedy enhance into two or three due to a failure of will.”

On being 1% higher each single day

“I continuously see folks rise in life who are usually not the neatest, typically not even essentially the most diligent, however they’re studying machines. They go to mattress each evening a bit of wiser than after they obtained up and boy does that assist — notably when you have got a future forward of you.”

On how he satisfied Buffett to change from shopping for low cost firms to buying nice companies

“Over the long run, it’s arduous for a inventory to earn a significantly better return than the enterprise which underlies it earns. If the enterprise earns 6% on capital over 40 years and also you maintain it for that 40 years, you’re not going to make a lot totally different than a 6% return—even if you happen to initially purchase it at an enormous low cost. Conversely, if a enterprise earns 18% on capital over 20 or 30 years, even if you happen to pay an costly trying value, you’ll find yourself with a wonderful end result. So the trick is stepping into higher companies. And that includes all of those benefits of scale that you may take into account momentum results.”

Investor temperament is a key to success

“If you happen to’re not prepared to react with equanimity to a market value decline of fifty% two or 3 times a century you’re not match to be a standard shareholder and also you deserve the mediocre end result you’re going to get in comparison with individuals who do have the temperament, who may be extra philosophical about these market fluctuations.”

Make investments aggressively into your greatest concepts

When you already know you have got an edge, it is best to guess closely. They don’t educate most individuals that in enterprise college. It’s insane. In fact you’ve obtained to guess closely in your greatest bets.

“One of many inane issues [that gets] taught in fashionable college training is {that a} huge diversification is completely obligatory in investing in widespread shares. That’s an insane thought. It’s not that simple to have an enormous plethora of excellent alternatives which are simply recognized. And if you happen to’ve solely obtained three, I’d slightly it’s my greatest concepts as an alternative of my worst. And now, some folks can’t inform their greatest concepts from their worst, and within the act of deciding an funding already is nice, they get to suppose it’s higher than it’s. I believe we make fewer errors like that than different folks. And that may be a blessing to us.”

How one can determine what to speculate your cash in

“Now we have three baskets for investing: sure, no, and too robust to know.”

“You’re in search of a mispriced gamble. That’s what investing is. And it’s important to know sufficient to know whether or not the gamble is mispriced. That’s worth investing.”

Exit when the percentages are in opposition to you

“What it’s important to be taught is to fold early when the percentages are in opposition to you, or in case you have an enormous edge, again it closely since you don’t get an enormous edge typically. Alternative comes, however it doesn’t come typically, so seize it when it does come.”

The significance of enterprise fashions and administration

“Put money into a enterprise any idiot can run, as a result of sometime a idiot will. If it received’t stand a bit of mismanagement, it’s not a lot of a enterprise. We’re not in search of mismanagement, even when we are able to stand up to it.”

Affected person investing will at all times win the short-term gamblers

“The large cash will not be within the shopping for or promoting, however within the ready.”

“It’s ready that helps you as an investor and lots of people simply can’t stand to attend. If you happen to didn’t get the deferred-gratification gene, you’ve started working very arduous to beat that.“

“The world is filled with silly gamblers and they won’t do in addition to the affected person buyers.”

“What Buffett and I did is we purchased issues that have been promising. Typically we had a tailwind from the economic system and typically we had a headwind and both method we simply saved swimming.“

On envy and evaluating your self with others

“Right here’s one fact that maybe your typical funding counsellor would disagree with: if you happen to’re comfortably wealthy and another person is getting richer quicker than you by, for instance, investing in dangerous shares, so what?! Somebody will at all times be getting richer quicker than you. This isn’t a tragedy.”

Keep away from hype and meme shares

“Warren and I don’t deal with the froth of the market. We hunt down good long-term investments and stubbornly maintain them for a very long time.”

Steer clear of leverage when investing

“There isn’t a such factor as a 100% certain factor when investing. Thus, the usage of leverage is harmful. A string of fantastic numbers occasions zero will at all times equal zero. Don’t rely on getting wealthy twice.”

“Warren nonetheless cares extra in regards to the security of his Berkshire shareholders than he cares about the rest. If we used a bit of bit extra leverage all through, we’d have 3 times as a lot now, and it wouldn’t have been that rather more threat both. We by no means wished to provide the least probability of us screwing up our fundamental shareholder place.”

Be taught, adapt and be quick to alter

“It’s a must to continue learning if you wish to change into an incredible investor. When the world adjustments, you have to change.”

“Warren and I hated railroad shares for many years, however the world modified and eventually the nation had 4 large railroads of significant significance to the American economic system. We have been gradual to acknowledge the change, however higher late than by no means.“

I’ve discovered lots from Charlie Munger in terms of life and investing. He might have left this world this morning, however his phrases will proceed to stay on and encourage generations to come back.

With love,

Price range Babe

[ad_2]