[ad_1]

Your finances is a good looking factor—your entire passions and priorities lined up in entrance of you, ready to do precisely what you inform them to do in help of the life you wish to dwell. You get to determine the best way to manage your classes with a finances structured simply the best way you prefer it. *Chef’s kiss.*

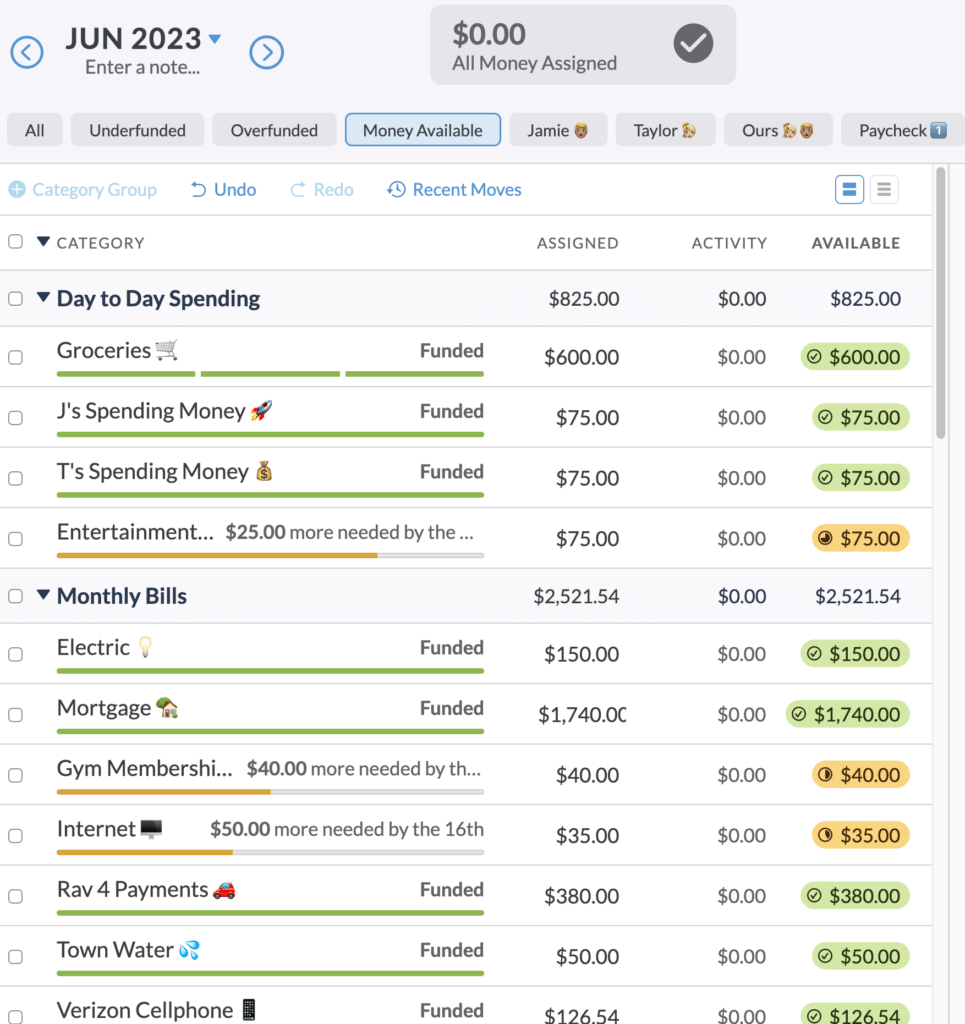

Once you’re on a mission to seek out out issues like, “How a lot did I spend—or overspend—on house items this month?” or “How a lot have I saved towards summer season trip?” you don’t want or wish to see each single class. Relying on what you’re doing in your finances, it’s possible you’ll solely want to see a couple of.

Simply name us Genie—your want is our command! We’re excited to introduce you to YNAB’s new Centered Views characteristic.

Centered Views

Centered Views permit you to see a subset of your classes relying on what you (or your companion!) wish to be taught, analyze, or evaluate.

You don’t open your finances for a similar motive each time. Generally you’ve obtained work to do, like if you’re paid and people {dollars} want jobs, or if you’ve obtained somewhat overspending to take care of.

Different occasions you simply must see completely different info another way that can assist you with a call. Perhaps you’re making an attempt to dig in somewhat deeper to spending patterns to tell an enormous life determination or fund an thrilling new chapter. (Simply ask Hannah what that’s like!) Centered Views allow you to zoom in on the classes that matter to you most within the second.

The way to Use Centered Views on Net

You’ll see Centered Views on the very high of your finances on Net. (Concern not: cellular is on the best way!) Simply click on on a view to allow, and voila, it seems. Click on All to get again to your full finances class view.

There are a lot of various kinds of Centered views and intelligent methods you should use them to your benefit. Let’s dive in!

Preset Views: Let Us Do the Heavy Lifting for You

There are 4 Preset Views that allow you to examine particular areas of your finances. These are primarily based on the state of your classes, like so:

Overspending View

You’ll solely see this one when there’s overspending in your finances. No must provide you with a warning if there’s nothing to deal with, in any case.

Use this view to see the place overspending struck. Once you discover it, keep in mind to ditch the guilt and Roll With the Punches! Merely transfer cash from one other class and carry on keepin’ on.

Underfunded and Overfunded View

Acquired class Targets? Have we obtained some views for you! Generally your classes want more cash, and generally they find yourself somewhat overstuffed.

The Overfunded View helps you “look by means of the sofa cushions” of your finances. When it’s essential cowl overspending, it’s a good suggestion to hunt for further cash! Now only one click on, and there they’re! You is perhaps pleasantly shocked by the additional {dollars} you’ve gotten tucked away.

Consider the Underfunded View as your Payday View. Click on Underfunded to see the classes which can be nonetheless searching for {dollars} to hitch the enjoyable. Give attention to what’s left to fund the following time cash rolls in.

Cash Obtainable View

Click on on Cash Obtainable, and we’ll solely present you the classes which can be partially or absolutely funded.

This view is useful for these moments when it’s essential make a spending determination with out all of the noise, like when you’ve gotten a kitchen gear disaster and Amazon has simply what you want, otherwise you and your companion may actually use a Thirsty Thursday date evening after a busy week of parenting.

Customized Views: Zoom In On What Issues to You

Look, we will’t know every thing that’s necessary to you in your finances. Perhaps you’re saving up for motorless boat elements to deal with the R2AK. Or a luxurious retreat the place all you do is go to the spa and take naps. Budgets are like snowflakes in any case—no two are the identical.

Solely you may decide your priorities and the way you need your cash to be just right for you. We wish to be sure you can customise views to your coronary heart’s content material.

You possibly can create Customized Views that include a subset of classes that YOU choose. Think about the probabilities!

What could be useful so that you can see? That is your likelihood to let your inside Price range Nerd shine. Once you create your personal Centered Views, you’ll acquire an entire new perspective in your finances.

Listed below are some concepts to get your wheels spinning:

Accomplice Views

Once you’re budgeting with a companion there are three varieties of bills: Yours, Mine, and Ours. Now you may create views to match!

What’s necessary to you proper now? What’s necessary to your companion? Do you’ve gotten shared financial savings objectives? What bills do you’ve gotten arising? Assist help one another in your private objectives and work collectively in your shared objectives.

And hey, this type of Customized View is perhaps simply what it’s essential function in a single finances as a substitute of two. This offers you a brand new method to have a look at your shared monetary image if you want it.

This can be tremendous useful in case your companion isn’t fairly as into YNAB as you might be (hold at it!), and also you simply must deal with a couple of classes to maintain them within the loop. No drawback—this view doesn’t want to incorporate a ton of classes, simply what issues most.

Paycheck Views

Whereas the aim is that can assist you get a month forward of bills, we all know that most individuals don’t begin out in that scenario. We’ve seen YNABers manage their whole finances by paycheck utilizing class teams. Now you should use Customized Views as a substitute!

Create a view for the classes you pay out of the primary paycheck of the month, and one other view that reveals the classes you pay out of the second paycheck. Readability and fast budgeting for the win!

Desires and Wants Views

Generally you simply wish to make certain the fundamentals are coated earlier than you begin including {dollars} to much less necessary classes.

A Desires and Wants view may enable you play out these ‘what if’ situations. What if you happen to misplaced or give up your job? Which classes would completely want to be funded? Create a brand new view and discover out. That is additionally a good way to learn how a lot it prices to be you for a month with out all of the nice-to-haves.

Themed Views

Generally you group classes collectively for one motive, however would like to view them from a unique perspective. You could possibly do a handstand, or simply create a view primarily based on a theme.

You may need all of your month-to-month payments in a single group, non-monthly in one other, and hey, possibly you also have a Want Farm. Wouldn’t it’s good to see all of the classes throughout these teams which can be associated to your home? Or automobile? Or rekindled love for journey? Straightforward peasy.

Kiddo Views

What about finances classes associated to kiddos? It’s possible you’ll manage your parenting bills a method for good outdated day-to-day budgeting, however generally you may wish to see a class breakdown by child. (You all the time knew it was the youngest who was costing you essentially the most!)

I Have Questions…

Good! We’ve got solutions. You’ll discover them right here.

We additionally wish to encourage you to simply begin enjoying with and constructing your personal Centered Views. Get these artistic juices flowing—the probabilities are countless! Warning: as you employ our Preset Views or construct extra Customized Views, you may get impressed to restructure your finances altogether. An exciting new world of complete monetary readability awaits!

Do you know you may invite as much as 5 folks to hitch your YNAB subscription at no further price? Share budgets and create new views with those you like essentially the most.

[ad_2]