[ad_1]

That’s the subtitle of an NBER working paper by Charles Grey, Abby E. Alpert & Neeraj Sood. The creator study current mergers between pharmacy profit managers (PBMs) and well being insurers. On the one hand, integration might helpful to customers. It might: (i) enhance operational efficiencies, and (ii) higher align PBM incentives with these of the well being plan (e.g., higher accounting for medical prices offsets). Nevertheless, the authors additionally be aware that there are two pathways by way of which the combination might depart customers worse off: (i) enter foreclosures and (ii) buyer foreclosures.

Enter foreclosures happens when a PBM owned by an insurer will increase the prices or reduces the standard of its providers supplied to insurers who compete with its mother or father insurer. For instance, the PBM might cross by way of a bigger share of producer rebates to its mother or father insurer than it passes by way of to rival insurers. The diploma of enter foreclosures is determined by the extent of competitors within the PBM market. If PBM markets have many rivals, then enter foreclosures is much less seemingly as rival well being plans experiencing enter foreclosures can change to considered one of many standalone PBMs. Nevertheless, if PBM markets are extremely concentrated then enter foreclosures is extra seemingly as rival plans have restricted choices to change to a different PBM. Buyer foreclosures, in contrast, happens when the downstream agency of a merged entity not purchases inputs from its upstream rivals. For example, when an insurer and PBM consolidate, the insurer’s well being plans will all the time use providers from its personal PBM, thus decreasing the potential variety of purchasers for standalone PBMs. The discount within the potential buyer base might in the end lead standalone PBMs to exit the market which might additional enhance the focus of PBMs.

The authors use various completely different datasets together with (i) publicly out there CMS PDP Panorama file datasets on Medicare Half D plan traits and enrollment (2010-2018), (ii) CMS Half D Contract and Enrollment Information comprise info on plan’s annual enrollment, and (iii) Determination Assets Group

(DRG) Managed Market Surveyor (MMS) (2010-2018) to determine which PBM every Half D plan makes use of.

Then, they carry out a difference-in-differences (DD) evaluation trying on the Half D market earlier than and after a big 2015 insurer-PBM merger (UnitedHealth-Catamaran), which the authors declare “eradicated the final important standalone PBM and shifted extra insurers into contracts with vertically built-in PBMs.” The pre-post evaluation compares modifications in premiums for vertically built-in plans (i.e., plan owns their very own PBM) in comparison with non-vertically built-in plans.

Utilizing this method, the authors discover that:

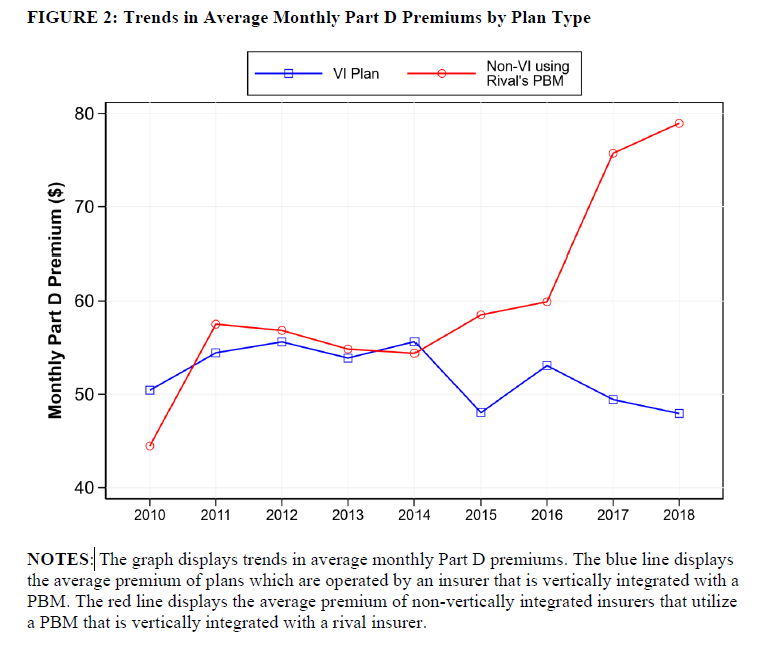

…nonvertically insurers skilled premium will increase of 36% when in comparison with vertically built-in insurers. These findings are according to vertically built-in PBMs partaking in enter foreclosures. Particularly, a vertically built-in PBM had a bigger incentive to boost prices for rivals when these rivals misplaced the flexibility to substitute to a standalone PBM.

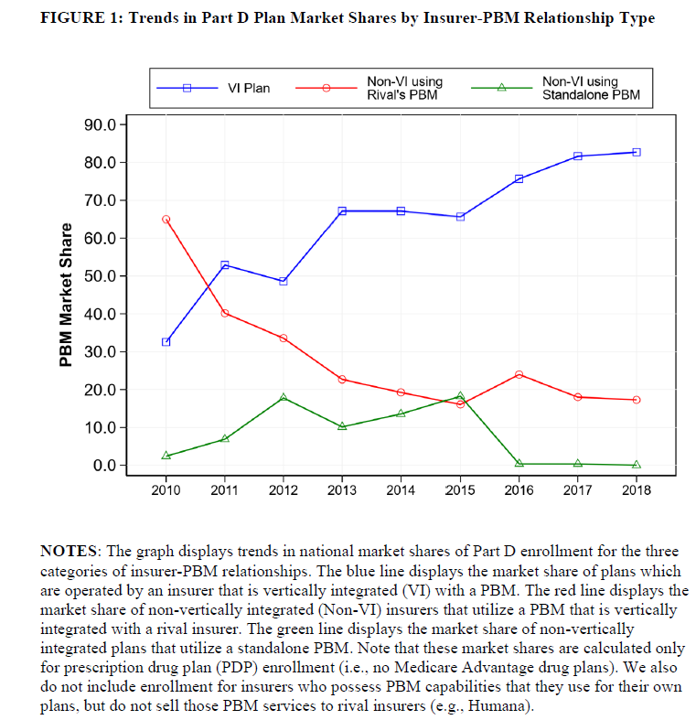

The figures beneath present that (i) vertically built-in plans started to dominate the market and (ii) costs for non-vertically built-in plans elevated greater than for vertically built-in plans.

[ad_2]