[ad_1]

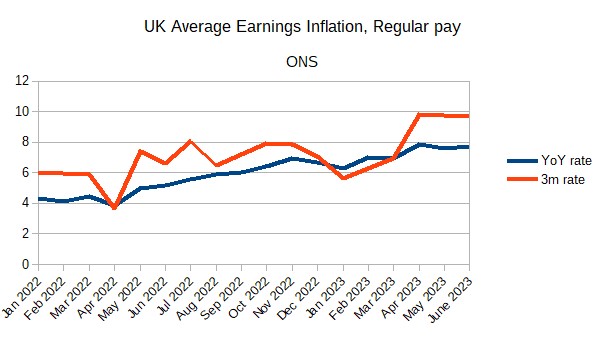

Two weeks in the past I

described how the UK’s inflation downside has now

grow to be about labour market energy and personal sector wage

inflation. Earnings

information launched final week has confirmed that view, in

half due to the newest information but additionally due to revisions to the

earlier two months. Right here is each 12 months on 12 months wage inflation, and

the annualised three month fee.

Yr on 12 months wage

inflation is at round 8%, and newer will increase have been above

that. If that continues it’s in keeping with 6-7% inflation, which

is properly above the federal government’s goal of two%. So personal sector wage

inflation has to come back down. Possibly wage inflation will comply with value

inflation down, or maybe additional efforts to scale back combination demand

and subsequently the demand for labour are wanted. That query is just not

the topic of this publish. As an alternative I focus on why some on the left discover

this prognosis for our present (not previous) inflation downside

tough.

A 12 months or so in the past,

when inflation within the UK was primarily attributable to increased vitality after which

meals costs, mainstream economists might legitimately be divided on

what the coverage response needs to be. On the one hand, lowering

combination demand within the UK was not going to have any impact on the

drivers of inflation. However, it might be argued that

coverage ought to grow to be restrictive to stop increased inflation changing into

embodied in expectations, as a result of if that occurred then inflation

would stay too excessive after the vitality and value shocks had gone

away. To make use of some jargon, opinions will differ on what the coverage

response to produce shocks needs to be. Till the start of 2022

central banks went with the primary argument, and didn’t elevate

rates of interest. When nominal wage inflation began rising, and it turned clear the labour market was tight, rates of interest began to rise.

Now mainstream

economists, no less than within the UK, are on clearer floor. Extra demand

within the labour market is pushing up wage inflation, and subsequently

combination demand must be lowered to carry personal sector wage inflation down.

There may be extra demand within the items market, pushing up

revenue margins, however the treatment can be the identical. (Knowledge on income is

much less updated than earnings, however as but there’s no

clear proof that the share of income has risen in

the UK.) Extra demand in both market must be eradicated, which

requires coverage to scale back combination demand, resulting in fewer

vacancies and nearly actually elevated unemployment.

The comprehensible

problem that many have with this prognosis is that actual wages have

fallen considerably over the past two years, and nominal wage

inflation is barely simply catching up with value inflation, so how can

wages be the issue? I’ve addressed this many instances, however let me

strive once more in a barely totally different means.

Inflation over the

final two years has been about winners and losers. The winners have

been vitality and meals producers, who’ve seen costs rise

considerably with out (within the case of vitality no less than) any improve

in prices. To the extent that the federal government can (and is prepared),

income from vitality producers might be taxed and the proceeds returned

to customers by subsidies. However the actuality is that a lot of those

increased income on vitality and meals manufacturing are acquired abroad,

and there’s nothing the UK authorities can do about them. As that is

basically a zero sum sport, those that have benefited should be

matched by those that have misplaced. The one subject turns into how these

losses are distributed between UK customers, the income of different UK

companies, the federal government and its workers.

Employees on this scenario might attempt to elevate nominal wage inflation to

reasonable this loss in actual wages, and that’s one interpretation of

what has been taking place. But if these within the personal sector are

profitable on this, who’re the losers? They’ll solely be companies,

by decrease income. Why ought to companies cut back their revenue margins

when wages are rising throughout the board? In a weak items market they

could be ready to take action, however there aren’t any indicators of that within the UK.

So companies are more likely to match increased wage inflation with increased value

inflation. That’s the main purpose why the worth of UK providers has

been rising steadily over the past two years (now at 7.4%).

The important thing level is

that UK actual wages didn’t fall over the past two years as a result of the

income of most UK companies rose. They fell as a result of the income of

primarily abroad vitality and meals producers elevated. Attempting to shift

this actual wage reduce onto the income of different UK companies won’t work,

and as an alternative simply generates inflation. It is usually why nominal wage

inflation, not actual wage inflation, is the essential variable right here. We

might debate whether or not it might be a good suggestion to see actual wages

recuperate at the price of falling income, however it hasn’t occurred so

far and is unlikely to occur sooner or later until extra demand is

changed by extra provide.

These on the left

who discover it uncomfortable to listen to that nominal wages are rising too

quickly have to keep in mind that since no less than WWII sustained actual wage

development, or the absence of development, within the UK has not come from decrease

income, however as an alternative comes primarily from productiveness development, with

occasional contributions from commodity value actions and shifts in

the alternate fee. The purpose

UK actual wages have hardly elevated over the past 15 odd years

is as a result of productiveness development has been very weak, vitality and meals

costs have risen and sterling has seen two giant depreciations. [1]

The pursuits of employees are served by insurance policies that assist actual wage

development, and never by seeing nominal wage development properly past what’s

in keeping with low and secure inflation.

If excessive inflation is brought on by extra demand then coverage must lower combination

demand, which can cut back the demand for items produced by most companies

main in flip to a lowered demand for labour. That nearly actually

means unemployment rises. Should you fear that the prices of further

unemployment is just too excessive, then one thing like a Job Assure scheme

makes loads of sense, though the potential

prices of such a scheme additionally have to be recognised. Such a scheme doesn’t change the logic, nonetheless, that inflation that

is brought on by extra demand must be corrected by lowering combination demand.

Is there an

different to utilizing weaker combination demand to carry down inflation?

If wage inflation is just too excessive, it’s as a result of companies are having to

grant giant nominal wage will increase with a view to get and maintain employees.

To keep away from the symptom (excessive inflation) it’s essential to take away its trigger (a

tight labour market), which suggests both rising the provision of

employees or lowering the demand for employees by companies. As a result of the

former is just not straightforward to do rapidly (e.g. due to controls on

immigration) then the latter requires a discount in combination

demand.

Within the 60s and 70s,

earlier than oil value hikes made a foul scenario worse, UK politicians and

some economists have been unwilling to see unemployment rise sufficient to

cease inflation rising. As an alternative they tried to make use of value and wage

controls to maintain each inflation and unemployment low. This failed,

and UK inflation rose from round 2% within the early 60s to eight% within the

early 70s, earlier than oil costs rose fourfold. The reason being

apparent given the logic within the earlier paragraph. If demand is

sufficiently sturdy (and subsequently unemployment sufficiently low)

that companies need to grant nominal wages will increase which might be

inconsistent with low inflation to draw extra employees, then

controls on costs and wages should persist to cease inflation

rising. However everlasting combination controls cease productive companies

attracting employees from unproductive companies, which damages future

actual wage development. Inevitably governments come beneath strain to calm down

combination wage and value controls, and subsequently all controls do is

postpone the rise in inflation.

Judging by feedback

on previous posts, the response of some on the left to all that is to

deny the economics, by claiming for instance that the Phillips curve

doesn’t exist. This additionally occurred so much within the UK of the 60s and

70s. The Phillips curve could also be onerous to estimate (due to the significance of expectations), and might not be

secure for lengthy durations, however the core concept that unemployment and wage

inflation are, different issues being equal, more likely to be inversely

associated at any time limit is sound, as has been proven time and

time once more since Phillip’s first regressions.

Proof ought to

at all times trump political preferences in economics. Often I’m

referred to as a ‘left-leaning’ economist, however that is partly as a result of on main

points since I began this weblog financial proof has pointed in a

leftward route e.g. austerity and Brexit have been horrible concepts.

Neither of these examples has something to do with political values

past the trivial [2]. Information, no less than since I’ve been writing

this weblog, are likely to have a left wing bias.

Inevitably, issues

are very totally different for a lot of exterior economics (and some educational

economists as properly). The discussions I discover hardest following my

posts are these with folks whose politics do decide,

deliberately or not, their financial views. These exchanges are onerous

as a result of nonetheless a lot economics I attempt to throw in, it’s by no means going

to be decisive as a result of it won’t change their political

views. As well as, if I’m arguing with them, their pure

presumption could also be that disagreement should come up as a result of my politics

is totally different from theirs, or worse nonetheless that the financial arguments

I’m placing ahead are made in dangerous religion due to hidden

political motives.

To those that do that

the perfect reply was

given by Bertrand Russell in 1959:

“When you’re

finding out any matter … ask your self solely what are the information, and

what’s the reality that the information bear out. By no means let your self be

diverted both by what you want to consider, or by what you suppose

would have beneficent social results if it have been believed.”

[1] Brexit is

liable for a type of depreciations, and it has additionally lowered

UK productiveness development.

[2[ By trivial, I

mean that reducing most people’s real incomes by large amounts for

no obvious gain is a bad idea.

[ad_2]