[ad_1]

In the event you learn a few of the UK

headlines, plainly France is having issue adjusting to the

actuality of longer lifespans. Its earlier retirement age (the age

when you will get a state pension) was 62, which is properly under most

different international locations. Macron has made that 64, in a reform imposed

on parliament. 64 remains to be comparatively low, but there

have been strikes and demonstrations towards this variation which have

been massive even by French requirements. A rolling strike by bin

collectors in Paris has left garbage on the streets.

Commentators

are asking whether or not these protests will convey in regards to the

finish of the present constitutional order in France.

At a macro degree, it

is smart to lift the pension age alongside life expectancy. In

most European international locations, together with France and the UK, state pension

schemes are unfunded, which signifies that at this time’s pensions are paid

for by these working at this time. If individuals stay longer you both must

cut back the worth of the state pension, increase these contributions, or

increase the retirement age. But whereas the life expectancy of these

reaching 65 elevated considerably within the many years earlier than 2010,

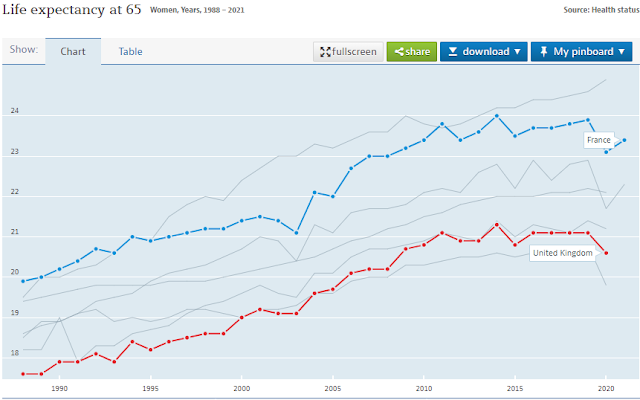

will increase have been extra modest since then. The OECD

information under is for ladies within the G7 international locations. Word that

UK life expectancy has all the time been low in comparison with all different G7

international locations besides the US.

The French pension

age was raised to 62 from 60 in 2010, and by 2019 (earlier than Covid) life

expectancy at 65 had risen by

round half a year since 2010. So the case for

elevating the retirement age in France from 62 to 64 will not be clearly

due to will increase in life expectancy since 2010. Certainly

projections recommend that the French pension system, whereas it should go

into deficit on the finish of this decade, will break

even once more by 2035 with none improve in pension

age.

So how does France

afford to have a comparatively low retirement age in comparison with different

international locations? It’s not as a result of state pension ranges are low. France

spends round 12% of GDP on state pensions, which is considerably

increased than the OECD common, which itself is above

the UK. The reply due to this fact must be increased ranges of

contributions, both immediately or not directly by way of a tax subsidy. I

famous in a

latest put up that though France had increased ranges of

productiveness than the UK, imply family incomes weren’t increased, and

a significant motive for that is that French employees retired earlier.

Larger French productiveness was paying for a decrease retirement age than

the UK and elsewhere, somewhat than increased post-tax incomes.

France has not

all the time been an outlier by way of having a low retirement age. It

was the socialist President François Mitterrand who in 1981 reduce the

retirement age from 65 to 60. Has France bought this trade-off between

revenue and retirement proper, as Simon Kuper suggests,

and most different international locations have it mistaken? The energy of widespread

feeling towards Macron’s increased retirement age would

recommend French individuals assume so, though it’s unimaginable to understand how

a lot of that is seeing a profit (retiring early) with out seeing the

price of that profit (decrease post-tax incomes whereas working).

The primary lesson

that France has to show the UK (and maybe different international locations) is to

have that debate. One of many penalties of getting a predominantly

proper wing press and a predominantly proper wing authorities is that

early retirement within the UK is seen

as an issue, somewhat than an achievement. Debates over

pensions within the UK too usually deal with contribution charges as given,

somewhat than a part of a trade-off between the retirement age and

contribution ranges. As I’ve famous earlier than, the UK debate usually

fails to put issues into an intertemporal context, and as a substitute

talks about employees versus pensioners as if employees won’t ever

retire.

The second lesson

that France has to show the UK is whether or not it is smart to have a

nationwide retirement age in any respect. As soon as we transfer from the combination to

fascinated with people, the unfairness of a uniform retirement

age turns into apparent. If the retirement age was 64, somebody who begins

work from the age of 18 will work (and due to this fact contribute) for 46

years earlier than retiring. Somebody who has a level will, in the event that they retire

at 64, work three years much less however nonetheless get a state pension. It might

appear to be fairer at a person degree to get rid of a retirement

age, and as a substitute be allowed a full state pension after working a

sure variety of years. (The choice to retire earlier than that variety of

years ought to all the time be accessible, however with a lower than full pension.)

This unfairness is

recognised in France, however not within the UK. France has had a

‘lengthy careers’ provision the place those that began working at an

early age can retire on a full pension earlier than the official retirement

age. That system is

strengthened as a part of elevating the retirement age to

64, so individuals who have labored for 43 years can retire with a state

pension earlier than 64. Thomas Piketty argues

that If in case you have 43 years of service, then you must have the ability to take

your full pension, full cease. [1]

Nevertheless this concept of

changing a retirement age by a years labored standards emphasises a

totally different potential unfairness drawback, as a result of state pensions are

annuities that you just obtain for so long as you reside. If everybody had

the identical life expectancy, then those that began work early and

due to this fact retired early would obtain a pension for longer than these

who retired later. How a lot is that this a difficulty? Simply as while you begin

work varies by (or even perhaps defines) class, so life expectancy

additionally varies by class.

It might be simple to

argue that this potential unfairness, created by changing a hard and fast

retirement age by years of service standards, doesn’t come up in

apply due to an ‘sad coincidence’ that the life

expectancy of those that begin work earlier is shorter by the identical

variety of years than those that work later. The proof we’ve got from

France for these benefiting from ‘lengthy careers’ and due to this fact

early retirement in France is

complicated, however doesn’t recommend such an sad

coincidence exists. Nevertheless, even when there was no distinction in life

expectancy between those that begin work at 18 and those that begin

work at 21, say, that isn’t an argument for a typical retirement age,

as a result of that’s clearly unfair to those that begin work at 18 and

due to this fact contribute extra to their pension with no extra

profit. [2]

If those that began

work at 18 can retire on a full pension at 61 by way of the lengthy profession

route, why does France have a retirement age in any respect and why is it

being raised? The reply lies within the element, and in

specific the allowances for taking time without work to look

after youngsters. On this respect the UK system, which supplies credit score for

these receiving little one profit, is extra beneficiant than the system in

France, though in fact it’s simpler to be beneficiant when the extent

of the state pension is a lot decrease. It might sound odd that these

particulars have provoked a lot anger, however as Piketty factors out if

they didn’t have an effect on lots of people by a substantial quantity Macron

wouldn’t be utilizing a lot political capital on insisting on elevating the

retirement age to 64.

The controversy in

France over pensions has somewhat little to do with affordability, and

as a substitute is about lifetime selection and equity throughout class. France

was uncommon in comparison with most international locations as a result of employees paid extra to

fund and revel in an extended retirement, significantly for the working

class who began work at 18 and significantly working class ladies.

The hazard in ending that is it should create another weapon for the

populist proper.

[1] Why does France

recognise the unfairness to those that begin work early created by a

mounted retirement age, whereas the UK doesn’t? Certainly, why does elevating

the retirement age within the UK trigger so little controversy in comparison with

France. The apparent motive is class, and specifically the lack

of political energy within the UK for individuals who didn’t do

a level. Elevating the retirement age from 62 to 64 in France

primarily impacts the working class, as a result of those that did a level

and began work of their early twenties will want and infrequently need to

work past the age of 64 to get their full pension. It’s the commerce

union motion in France that’s main the protests towards elevating

the retirement age.

[2] A technique of

coping with totally different life expectations throughout occupations has been

proposed

by Ian Mulheirn. He suggests treating the pension as a lump sum that

must be invested in an annuity, and the annuity supplier

would regulate for various group life expectations. My very own view is

{that a} authorities run scheme could be preferable, as a result of non-public

annuities expose pension holders to rate of interest danger.

[ad_2]