[ad_1]

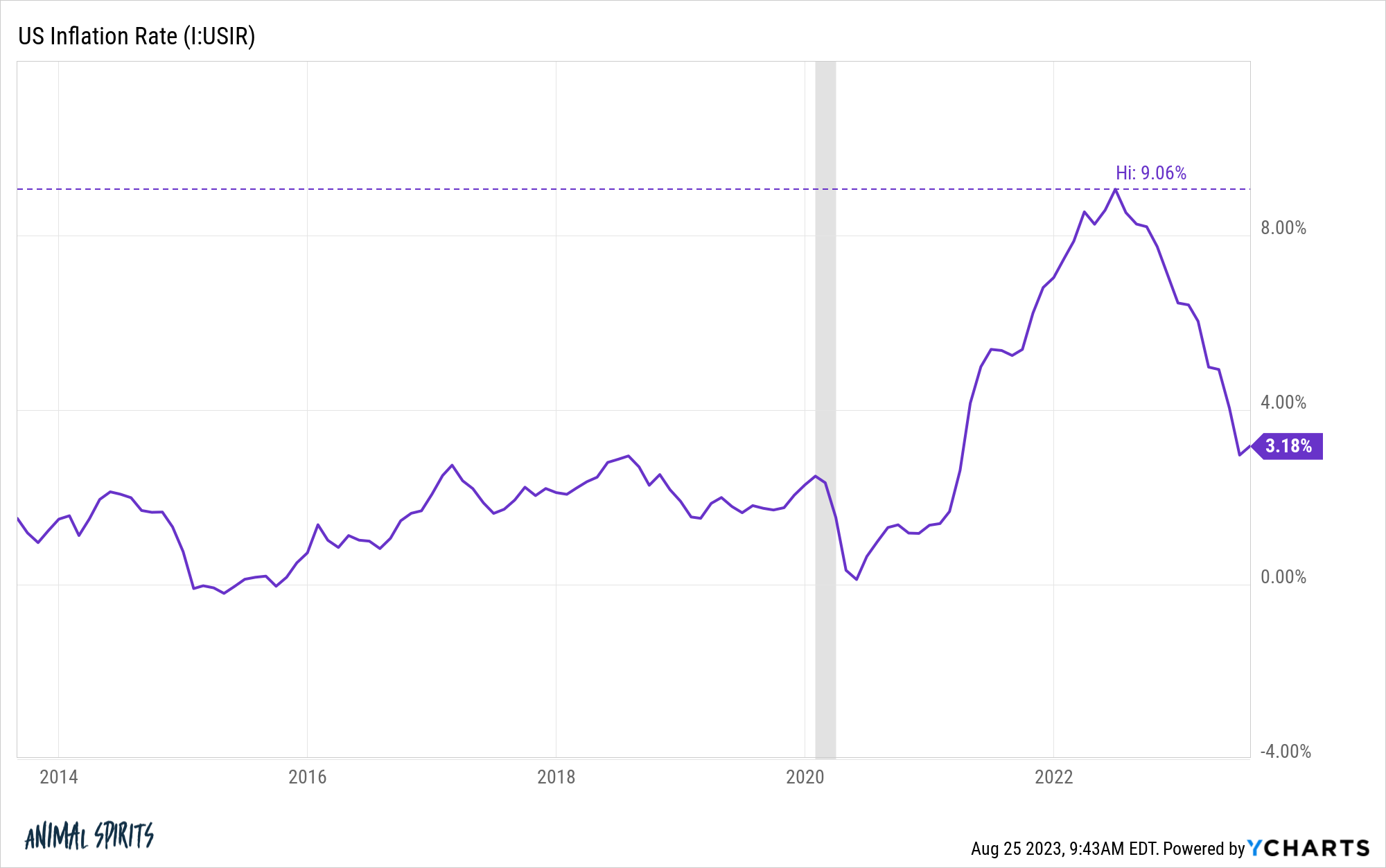

Inflation has come down from greater than 9% to a extra affordable 3.2%:

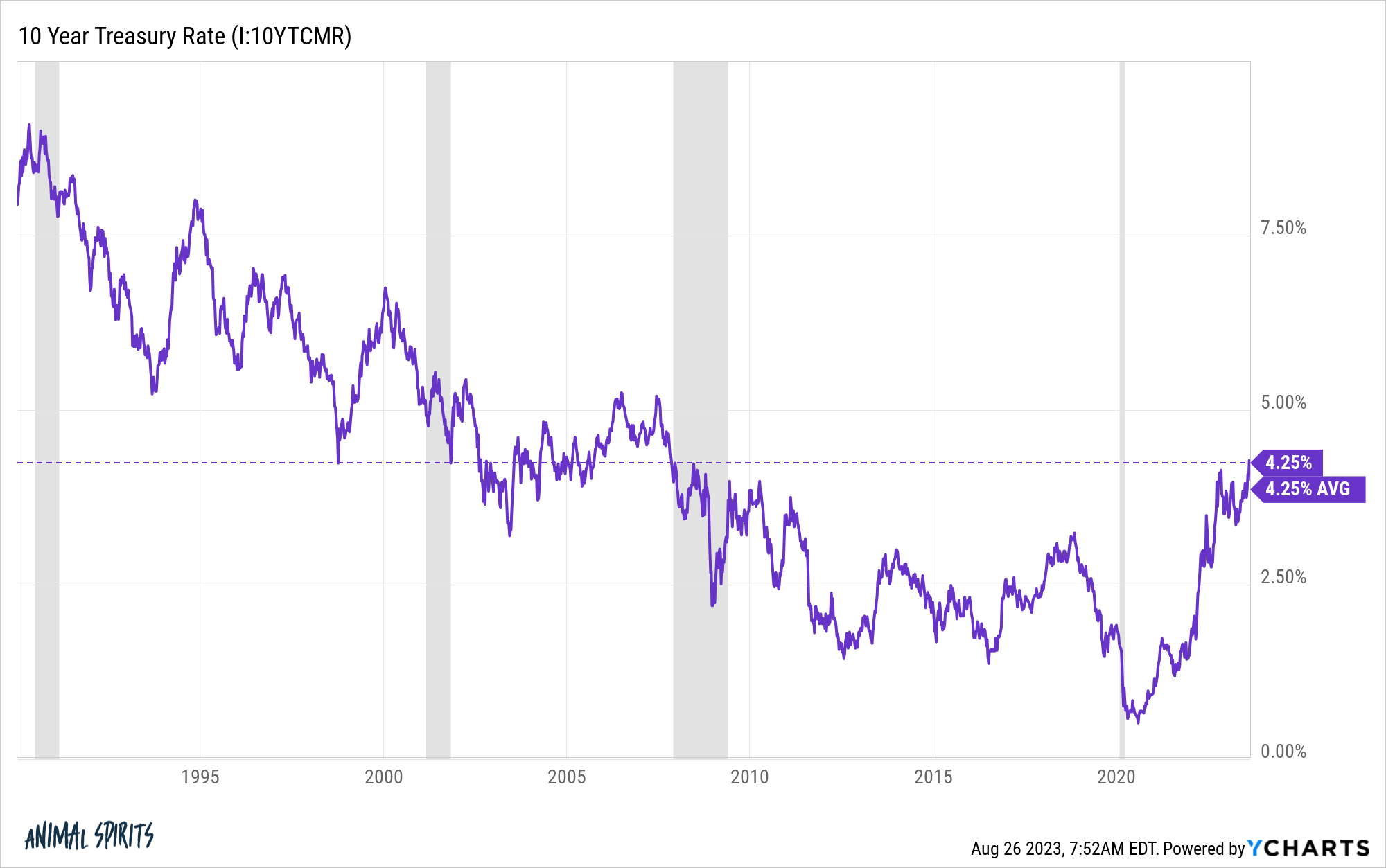

Bond yields are actually a lot larger than they had been within the 2010s however 4.25% on the benchmark 10 yr Treasury continues to be not excessive from a historic perspective:

It’s truly proper on the common since 1990.

In case you had armed me with this info 12 months in the past I’d have assumed mortgage charges can be decrease, in all probability someplace round 6%.

I’d have been mistaken.

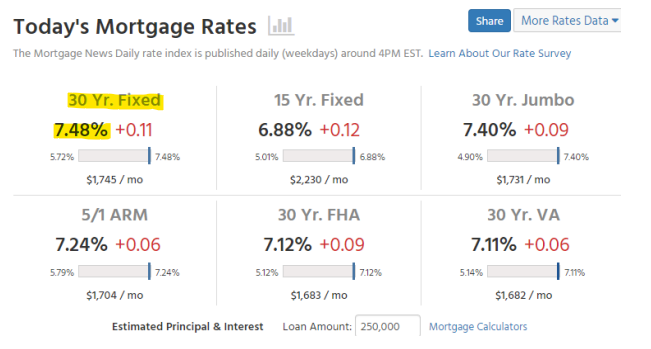

In keeping with Mortgage New Each day, the 30 yr fastened fee mortgage hit 7.5% this week:

With the ten yr at 4.2% and inflation at 3.2%, mortgage charges ought to be decrease…proper?

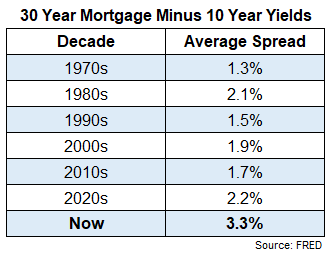

Mortgage charges usually commerce a diffusion to the ten yr Treasury yield. Listed here are the common spreads by decade going again to the Seventies:

If we had been at Nineties unfold ranges we’d be mortgage charges of 5.7%. Even when we had been on the common for the 2020s up to now they’d be at a extra affordable 6.4%.

So why are spreads so excessive proper now?

It’s somewhat wonky however there are causes for this.

Whenever you take out a mortgage most banks don’t wish to preserve that mortgage on their books in order that they package deal a bunch of mortgages into mortgage-backed securities. These bonds are a set of mortgages that include a periodic yield cost similar to another bond.

Mortgage bonds have a distinct threat than most different sorts of bonds referred to as prepayment threat. Most individuals who take out a 15 or 30 yr mortgage don’t truly make each cost on that mortgage from day one.

As a substitute, most individuals refinance, which repays that unique mortgage. Or they transfer earlier than the mortgage is paid off. So the length of those bonds shouldn’t be 15 or 30 years. For many of them it’s in all probability extra like 6-8 years.

The skilled fastened revenue patrons who spend money on these securities have parameters across the sorts of bonds they’ll purchase.

Prepayments on these bonds have fallen off a cliff as a result of refinancing has come to a standstill. In keeping with Fannie Mae, refinancing quantity is down 90% from the height in 2020.

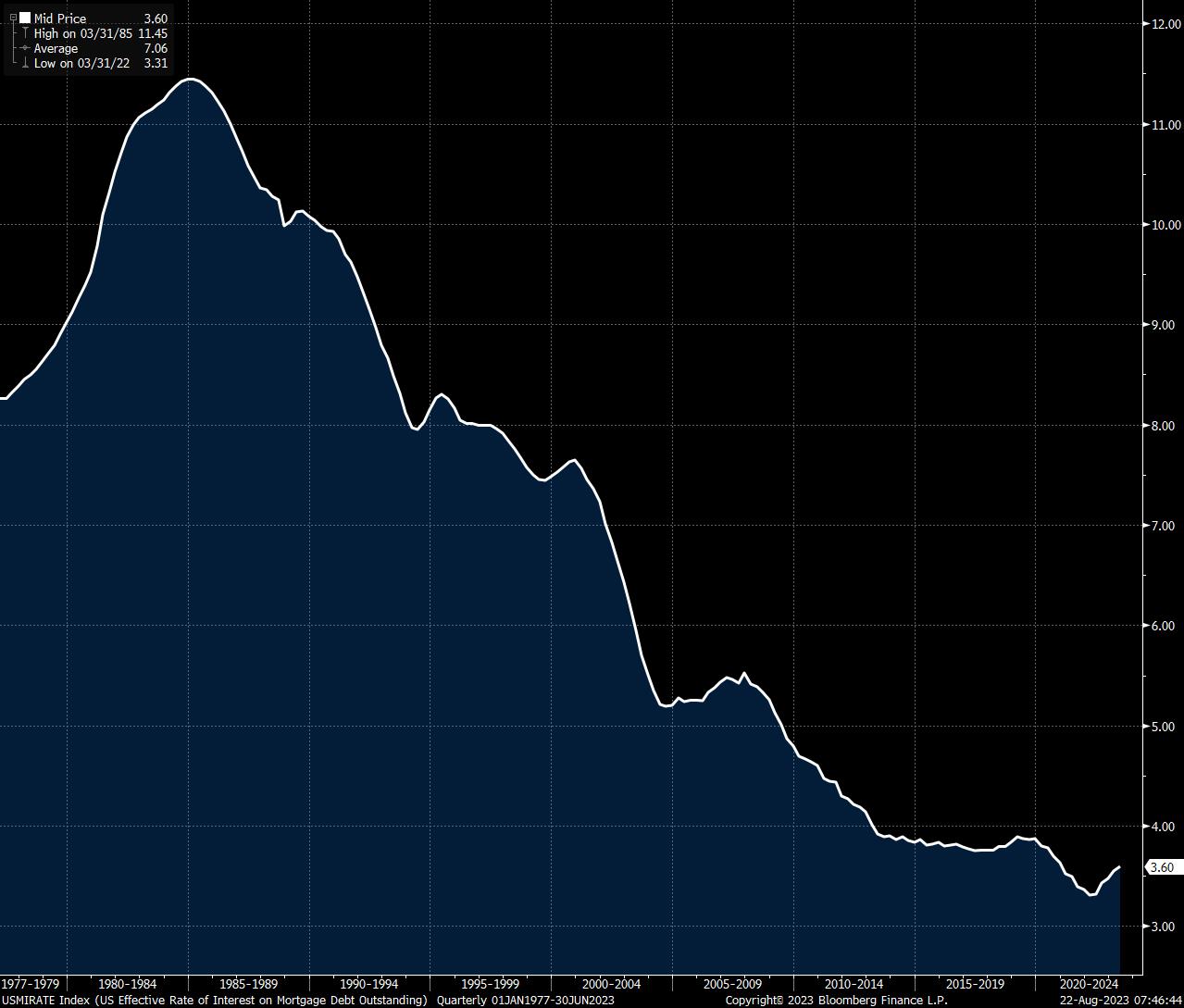

I’m guessing a lot of the exercise remaining is cashout refis contemplating the common mortgage fee for all debtors proper now could be 3.6% (through Robert Burgess):

Nobody has to refinance proper now.

Whenever you mix the shortage of refinancing exercise with the shortage of provide of properties on the market, there isn’t a lot taking place within the housing market in the meanwhile. Meaning there isn’t a lot taking place by way of prepayments in mortgage-backed securities.

The rise within the length of those bonds has led to a blowout in spreads between mortgage charges and authorities bonds, making an unhealthy housing market even worse.

One other extenuating circumstance right here is the Fed in all probability jacked up the mortgage market once they purchased a bunch of those mortgage-backed securities through the pandemic.

They already owned $1.4 trillion value of mortgage bonds heading into the pandemic in early-2020 however that quantity ballooned to just about $3 trillion following the entire quantitative easing to fight the financial slowdown and preserve credit score markets functioning.1

Add to all of this the velocity of the speed rise going from 3% to 7%, and the mortgage financing market isn’t functioning like a well-oiled machine in the meanwhile.

So shoppers are struggling by means of seemingly the worst housing affordability we’ve got ever seen.

The Fed is punishing debtors in a giant approach proper now.

The issue is so many individuals have such low charges locked in that we’re not going to see an enormous flood of refinancing exercise even when mortgage charges decline from right here.

Surprisingly, mortgage charges are literally beneath common going again to 1970 (the earliest I’ve information):

That common is being skewed larger by the ridiculous mortgage charges within the early-Eighties however it’s at the very least value contemplating the potential of charges remaining uncomfortably excessive.

Past the extenuating circumstances within the mortgage market proper now the trail of charges going ahead has rather a lot to do with the Fed’s actions and the state of the economic system.

If we get a recession and/or inflation continues to fall you’ll assume the Fed will minimize charges. However good luck predicting financial exercise from right here.

We had been presupposed to be in a recession by now but right here we’re, looking at the potential of one of many quickest quarters of GDP progress in 20 years.

Mortgage charges ought to fall as soon as the economic system cools off a bit, one thing that ought to occur finally with charges this excessive.

I simply don’t know the way excessive they’ll get within the meantime or how far they’ll fall when the economic system does gradual.

The problem for these on the lookout for higher ranges of affordability could possibly be that we’ll seemingly see a spike in demand for properties when mortgage charges do lastly fall.

Additional Studying:

The Worst Housing Affordability Ever?

1The Fed clearly overstayed its welcome on this market.

[ad_2]